About 'debt to total assets ratio interpretation'|Debt Rattle, December 20 2008: War in the Labour Markets

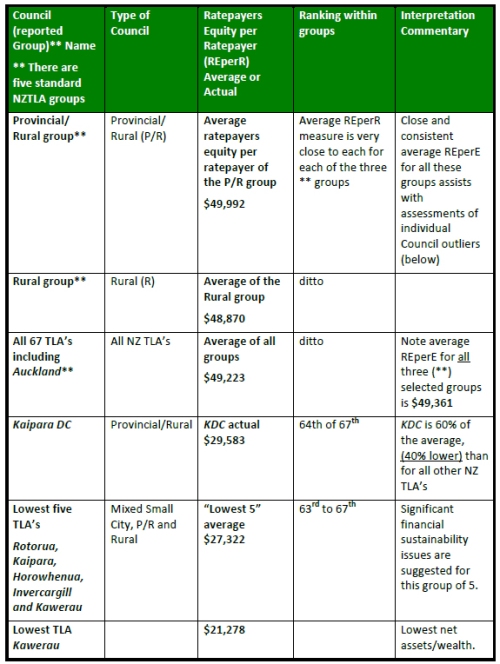

Financial ratios are the comparative values which are used to scrutinize and keep an eye on a company's performance. An analysis of financial statements is based on these ratios in a ratio analysis. A company obtains the basic data for its ratio analyses from its own income statement and balance sheet. A ratio analysis is the interpretation of the ratio value - what it means. There are two types of ratio comparisons that can be made: cross-sectional and time-series. (Gitman, 2009, p. 54) Cross-sectional analysis is the comparing of one company's financial ratio(s) to another company's financial ratio(s) when both companies are in the same industry. These analysis entail a comparison at the same point in time. For example, Microsoft may want to compare its total liabilities to net worth ration to that of Apple. Chevron may want to compare its return on total assets ratio to that of Exxon. Cross-sectional analysis can also include the comparing of a company's financial ratio to the industry average financial ratios. When there is a noteworthy deviation to the positive or negative side of the industry average, then this needs to be investigated. Even a high deviation to the positive side can spell trouble. (p. 54) Time-series analysis examines a company's financial performance over time. By comparing the present to past performance, via ratios, analysts can assess a company's development. Positive and negative trends can be exposed by using multiyear comparisons. A large problem may be revealed through any striking year-to-year changes. (p. 56) As with most methods of various types of methods used in the world today, there is also a hybrid method of cross-sectional analysis and time-series analysis, simply referred to as combined analysis. Combined analysis is considered the most functional way to use ratio analysis. Utilizing this combined view, analysts are able to evaluate any trends in the behavior of the ratios in relation to trends in the industry. (p. 56) Financial ratios can be divided into five categories: liquidity, activity, debt, profitability, and market ratios. To gauge risk, analysts use liquidity, activity, and debt ratios. To calculate return, analysts choose profitability ratios. To quantify both risk and return, analysts opt for market ratios. There are two types of liquidity ratios: current ratio and quick (acid-test) ratio. The current ratio is one of the most commonly referenced financial ratios as it gauges a company's capability to meet its short-term commitments. It is derived by dividing the present assets of the firm by the firm's present liabilities. Most often, the higher the current ratio, the more liquid the firm is thought to be. A current ratio of 2.0 is infrequently named satisfactory. However, a value's suitability is dependent upon the industry in which the company operates. The quick (acid-test) ratio is analogous to the current ratio except that it does not include inventory, which is most often the least liquid current asset. The quick ratio is calculated by subtracting the firm's inventory from its current assets and then dividing that resulting number by the firm's current liabilities. A quick ratio of 1.0 or higher is intermittently recommended, but, just like the current ratio, what value is considered adequate is for the most part dependent on the industry. The quick ratio is a better gauge of by and large liquidity only when a company's inventory cannot be simply transformed into cash. If inventory is liquid, then the current ratio is the favored measurement of on the whole liquidity. (p. 58-59) There are four types of activity ratios - inventory turnover, average collection period, average payment period, and total asset turnover - which measure the quickness with which different accounts are transformed into sales or cash. Inventory turnover typically measures the movements, or liquidity, of a company's inventory by dividing the cost of goods sold by the inventory. The turnover amount that is the result is only important when it is contrasted with that of other companies in the same industry or to the company's past inventory turnover. The average collection period, or average age of accounts receivable, is valuable in evaluating credit and collection policies. To obtain this value, the accounts receivable is divided by the average sales per day (annual sales divided by 365). The resulting number will signify how many days it takes to collect an account receivable, on average. If a company has 30-day credit terms with its clients and they have an average collection period value of 55, then that may be an sign of an inadequately managed credit or collection division. If the company finds that a 60-day credit term would be worthwhile, then the 55 days would then become satisfactory. The average payment period, or average age of accounts payable, is calculated just like the average collection period, except you are dividing accounts payable by the average purchases per day (annual purchases divided by 365). This is a tricky value to determine because a company's annual purchases is not presented in financial statements. Therefore, purchases are typically an approximation as a given percentage of cost of goods sold. This value is significant only in relation to the average credit terms given to a company. When a company is applying for credit, creditors will be most interested in this value because it provides a good look into how a company pays its bills. If the average payment period is 10 days and the company has 30-day terms across the board, then their credit rating will be much higher than if the value was 50. The total asset turnover shows the efficiency with which a company uses its assets to produce sales. This value is derived by dividing sales by total assets. Most often, the higher a company's total asset turnover, the more resourcefully its material goods have been used. Total asset turnover is probably the most important ratio to management as it shows if a company's actions have been financially efficient. (p. 59-62) Debt ratios offer analysts the ability to see the quantity of money a company is using to produce profits that is coming from outside sources. There are three types of debt ratios: debt ratio, times interest earned ratio, and fixed-payment coverage ratio. The debt ratio measures the fraction of total assets financed by the company's creditors. This is calculated by dividing total liabilities by total assets and the higher the resulting number, the greater the amount of outside money is being used to produce profits. The times interest earned ratio gauges a company's ability to make agreed upon interest payments. This is calculated by dividing earnings before interest and taxes by interest and the higher the resulting value, the more capable the company is to carry out its interest responsibilities. A resulting number of at least 3.0 is often recommended, although 5.0 is the more preferred value. The fixed-payment coverage ratio measures a company's ability to meet all its fixed-payments commitments, such as lease payments, loan interest and principal, and preferred stock dividends. Just like with the times interest earned ratio, the higher the resulting value, the better. To calculate this, the sum of earnings before interest & taxes and lease payments is divided by the sum of interest, lease payments, and the product of the sum of principal payments and preferred stock dividends and 1 divided by 1 minus the corporate tax rate applicable to the company's income. (p. 62-65) Profitability ratios allow analysts to measure a company's profits with regards to a given amount of sales, particular amount of assets, or the owner's investment. There are seven profitability ratios: common-size income statements, gross profit margin, operating profit margin, net profit margin, earnings per share (EPS), return on total assets (ROA), and return on common equity (ROE). A common-size income statement is an income statement where each item is shown as a proportion of sales. The gross profit margin measures the fraction of every sales dollar after a company has paid for its merchandise. This value is derived by dividing the remainder of sales minus cost of goods sold by sales. The operating profit margin measures the proportion of every sales dollar left over after all costs and expenses, not including interest, taxes, and preferred stock dividends, are removed. This is calculated by dividing operating profits by sales. The net profit margin measures the percentage of every sales dollar left over after all costs and expenses, this time including interest, taxes, and preferred stock dividends, have been subtracted. This is calculated by dividing earnings available for common stockholders by sales. The EPS characterizes the dollar quantity earned on the part of every outstanding share of common stock. It is calculated by dividing earnings available for common stockholders by the number of shares of common stock outstanding. The ROA measures the on the whole effectiveness of a company's management in producing profits with its accessible assets. This is derived by dividing the earnings available for common stockholders by the total assets. The ROE gauges the return earned on the common stockholders' investment in the company. This is calculated by dividing the earnings available for common stockholders by the common stock equity. (p. 65-69) Market ratios compare a company's market value to particular accounting costs, as measured by its present share price. There are two market ratios: price/earnings (P/E) ratio and market/book (M/B) ratio. The P/E ratio measures the quantity that investors are prepared to pay for each dollar of a company's earnings. With a higher P/E ratio comes higher investor assurance. This is calculated by dividing the market price per share of common stock by the earnings per share. The M/B ratio gives an evaluation of how investors see a company's performance. In order to calculate the M/B ratio, the book value per share of common stock must first be calculated, which is done by dividing common stock equity by the number of shares of common stock outstanding. Then, to figure out the M/B ratio, the market price per share of common stock is divided by the book value per share of common stock. (p. 69-70) All of these financial ratios can be utilized to give an idea of the financial strength of a company. Managers can use these numbers to evaluate their own processes, policies, and performance. Potential investors can utilize these numbers to decide whether or not they want to invest. Potential creditors can base their decisions on whether to extend credit off of these financial ratios. Ratios are an easy way to compare two companies in the same industry as well as an easy way for a company to measure itself against its own past performance. References Gitman, L. (2009). Principles of Managerial Finance (12th ed.). Pearson Prentice Hall: Boston, MA |

Image of debt to total assets ratio interpretation

debt to total assets ratio interpretation Image 1

debt to total assets ratio interpretation Image 2

debt to total assets ratio interpretation Image 3

debt to total assets ratio interpretation Image 4

debt to total assets ratio interpretation Image 5

Related blog with debt to total assets ratio interpretation

- malaysiandemocracy.wordpress.com/...RPK (wakakaka) for his amazing courage, assets and resources had he ...other side’ as well. And, according to my ex-MACC Deep Throat, this is still...

- financialinsights.wordpress.com/... at such lofty levels relative to rent in many large centres, it...few years. If the price/rent ratio is significantly higher than the...

- theautomaticearth.blogspot.com/... will be an asset of the company and not a liability... behind, according to former Citigroup traders... bestowed on the debt. While the sheer size of Citigroup...

- www.ritholtz.com/blog...yield, it may still have value in relation to other assets. If high indebtedness is indeed the...counterproductive, then a prolonged state of debt induced coma may so limit...

- www.ritholtz.com/blog...opinion. Investors continue to buy the better (US, Japanese, German and UK) sovereign debt, though at these levels looks total madness. However, in the short term...

- theautomaticearth.blogspot.com/...," he said. "You need so many teachers. You have a student-teacher ratio of 26 to 1. Do the math." Last year, only about 100 teachers received layoff...

- theautomaticearth.blogspot.com/...to figure out how to get the bad assets off the banks’ books...increasingly leaned on ratings to police debt investing. In 1991, the SEC...

- theautomaticearth.blogspot.com/...Fannie/Freddie like USG assets/liabilities...interest paid on debt is tax-deductible...' total shares, then..., however, subject to federal income...

- bankingeconomics.blogspot.com/...ratio to GDP) and total (gross) private sector debt doubled to nearly 500% ratio to GDP i.e. private...there are asset (including...et.al.'s absurd interpretation of the correlation...

- theautomaticearth.blogspot.com/...New York branch, to buy the assets from the banks and... the $20 billion to purchase so-called collateralized debt obligations—the...

Related Video with debt to total assets ratio interpretation

debt to total assets ratio interpretation Video 1

debt to total assets ratio interpretation Video 2

debt to total assets ratio interpretation Video 3

0 개의 댓글:

댓글 쓰기