About 'debt total assets ratio'|Why Total Debt/GDP Hides West's Sick Finances

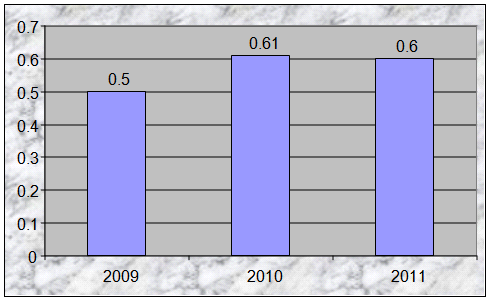

Hewlett Packard Hewlett Packard has become one of the largest Electronics Companies in the World. The Company was established in 1939 by Bill Hewlett and David Packard in Paolo Alto, California. The companies specialize in the production of personal computers, servers, storage devices, printers, networking equipment, Computer monitors, digital cameras, digital imaging equipment, digital media equipment, printers and more. The future of Hewlett Packard seem bright with is annual revenue increasing by more than 6 million dollars in 2004. Hewlett Packard's assets outweigh it's liabilities with a current ratio of 1.8 which means greats things for there share holders. There dividend payout it that of $.32 per share and that is projected to raise by $.3 by the end of the 2006 fiscal year. Hewlett Packard recently acquired Compaq computers which should aid in strengthening there financial outlook by the end of 2006 and even though there merger met with some opposition it was proven to be very profitable for the company and its shareholders. All in all Hewlett Packard is posting great numbers and is positioning itself to be a very promising investment. NYSE Symbol: HPQ Fiscal Year End: October 2004 Sales (mil): $79,905.00 2004 Employees: 151,000 Current Ratio: 1.43 Asset Turnover Ratio: 1.1 Total Debt to Total assets Ratio: 0.50 Price/Earning Ratio: 28.53 Dividend Payout: 27.8% Sanyo Sanyo produces consumer and commercial electronics. Sanyo has more than 170 subsidiaries throughout the world. They create things ranging from electric bicycles to semi conductors. They also produce items such as CD players, Televisions, Appliances, Cell phones, Batteries and more. Sanyo has been struggling a bit financially within the past year its total revenue increased by a mere $350,000 in the year 2004. However its assets outweigh it's liabilities with a current ratio of 1.78. There debt to assets ratio is average which helps to keep Sanyo in the running. Sanyo can be a great investment with shares costing about $11.36 per share and dividend payout of about $.12 per share. This is set to decrease slightly by the end of the fiscal year. Sanyo's future is still however very promising with recent alliances with Companies such as Samsung, Sharp, Seiko Epson and others. I would say definitely keep Sanyo on your watch list. NASDAQ Symbol: SANYY Fiscal Year End: March 2005 Sales (mil): $25,173.7 2004 Employees: 82,337 Current Ratio: 1.09 Asset Turnover Ratio: 1.0 Total Debt to Total Assets Ratio: 0.89 Price/Earning Ratio: - - Dividend Payout: - Sony Sony is one of leading electronics companies in the world. However electronics is just the tip of the iceberg for this multifaceted company. With ties, to music, movies, and home of one the most popular gaming consoles (PlayStation 2) ever Sony is a force to be reckoned with Sony appears to be one of the main front runners of the game console division, however sales of other products like there DVD recorders, digital cameras, music and others have dropped. Thanks to competitors like Apple and its Ipod as well as Samsung and its entire consumer electronics line. Sony is seemingly being left in the dust. Sony's revenue dropped by more than 6 million dollars in the year 2004 and projections are not looking good for the end of the 2005 fiscal year. Assets however outweigh liabilities with a current ratio of 1.19 however that number is expected to decrease by the end of the 2006 fiscal year which could mean serious financial trouble for the Sony corporation. Hopefully the launch of the new Play Station will breathe some life into this company but until then I suggest you steer clear of Sony. NYSE Symbol: SNE Fiscal Year End: March 2004 Sales (mil): $66,912 2004 Employees: 162,000 Current Ratio: 1.19 Asset Turnover Ratio: 0.8 Total Debt to Total Assets Ratio: 0.70 Price/Earning Ratio: 31.90 Dividend Payout: 15.1% The most promising company out of these three electronics giants appears to be Hewlett Packard. With it's promising numbers, successful mergers, and increasing revenue. HP shares go for about $29 a pop and they are expected to rise over the holiday season. HP also has few more tricks up its sleeves to help increase sales and beef up profit. I tried to find out just what they were but everything appears to be on the extreme hush, hush. Basically HP appears to be the more solid and promising choice, I would personally invest in this company. My verdict Hp all the way! |

Image of debt total assets ratio

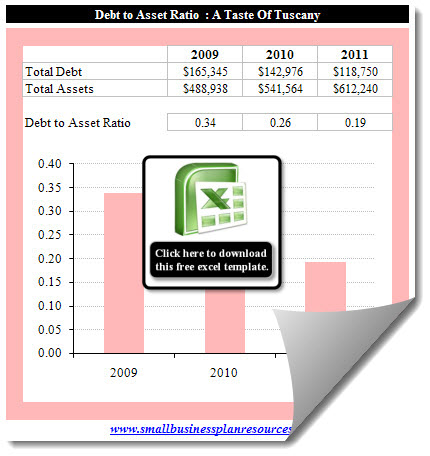

debt total assets ratio Image 1

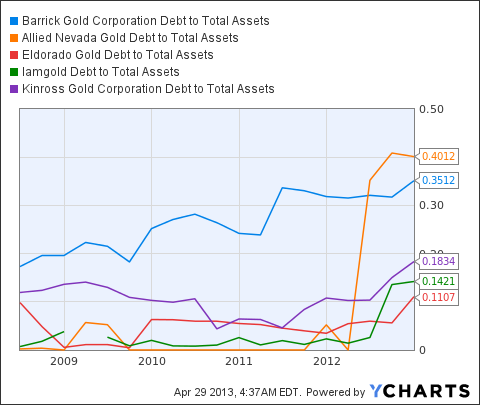

debt total assets ratio Image 2

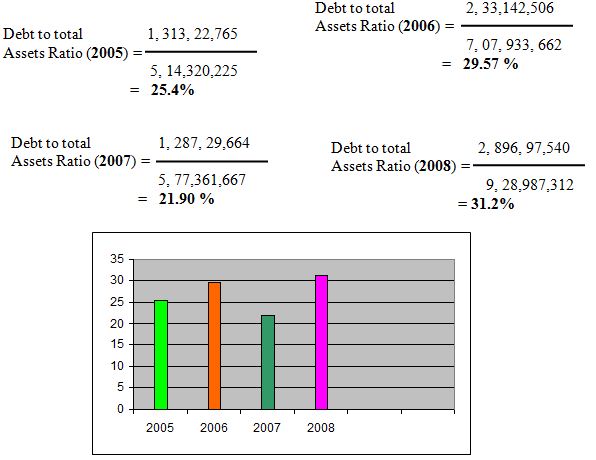

debt total assets ratio Image 3

debt total assets ratio Image 4

debt total assets ratio Image 5

Related blog with debt total assets ratio

- fredmba.blogspot.com/...debts with its assets. Debt-to-Assets = Total Liabilities /Total Assets The lower ratio the better as it means...

- datacenterlinks.blogspot.com/...article about the highest debt to asset ratio companies - which is where.... Investopedia defines Total Debt to Total Assets as: "A metric...

- debt-restructuring.blogspot.com/...what proportion of debt has relative to assets. The ratio of total debt and total assets. Debt ratio use in wide For the company to measure leverage of the company that high debt give high...

- harbinus.blogspot.com/...very strong with no long term debt and a current ratio of 5:1 (short-term assets:short-term liabilities... CESV 70% of the total savings from the...

- fredmba.blogspot.com/... using to finance its assets. Debt-to-Equity = Total Liabilities / Total Equity The lower ratio the better as it ...

- myinvestingnotes.blogspot.com/...investment than one with a minimal amount of debt on its books. The total debt to total assets ratio is used to determine how many of a company's assets...

- lesmaes.wordpress.com/... nominal GDP versus total household debt (ratio debt to GDP at the bottom): As you can...their debt growth with their cash-flow and asset growth. And on the cash-flow side, it...

- suqalmal.blogspot.com/...transfer, sell or pledge its assets. Loan agreements...typically include financial ratios (debt to equity) etc. which...report of JPMorgan Chase. Total consolidated...

- ipezone.blogspot.com/... out is that the ratio of total debt to GDP is a misleading... or acquiring assets. Where measures of net debt...

- theautomaticearth.blogspot.com/...and Camp Redtails. Carroll said the resort is an important asset to the LGBT community because of its openness to alternate lifestyle groups from Catholic...

Debt Total Assets Ratio - Blog Homepage Results

optimalby

... 2503c Trust for Minors Acid Test Ratio Active Participant Accumulated ...Cross Purchase Crummey Power Cummulative Tax Current Assets Custodianship Deferred Compensation Arrangement...

Related Video with debt total assets ratio

debt total assets ratio Video 1

debt total assets ratio Video 2

debt total assets ratio Video 3

0 개의 댓글:

댓글 쓰기