Irene Breeding 's blog ::September 13 2010: Basel III: We Lost, The Banks Won

Just picture your firm having access to all the working capital you need. Seem impossible? Not really... if you have a solid understanding of your options and your firms capability of qualifying or executing on those options. Whether you're the largest corporation in Canada or a small new start up (and everything in between) your business needs working capital. In Canada small business financing loans and financing arraignments for working capital are limited to a handful of possibilities - but being aware of what they are and qualifying for them could be the solution to your constant focus on cash flow via some sort of working capital loan. It is probably easier than you think to ensure you are addressing the cash flow challenge correctly - where it gets somewhat ' thorny ' is matching a solution to the problem or locating an expert that can provide you with the business financing assistance you need . Two key elements of your first step working capital assessment are your gross margins and your turnover. That's the big problem we have with text book / academic solutions to working capital - they point you to the text book calculation - give you a formula which essentially has you subtracting current liabilities form current assets, and voila ! the inference is you have working capital . However, our clients have never paid a supplier or completed a company payroll with a ratio! To properly assess your working capital needs focus on understanding your turnover - how much inventory do you carry, what are the days outstanding in inventory, and as importantly, or more importantly, are your receivables turning over . Have you realized that for many firms 80% or so of the total of all the business assets you have are tied up in A/R, inventory, and, on the other size of the balance sheet let's not forget payables. So can you have financial success based on your new found knowledge and analysis of your cash flow and asset turnover. We think you can. Canadian business financing solutions to small business finance loans really revolve around a couple viable solutions. Typically, in our experience Canadian chartered banks cant satisfy your business working capital needs - if only for the reason that they rarely finance inventory and require significant merit in your overall financials, profitability, external collateral, personal credit worthiness, etc . So, where do you go from there? The other solutions are very viable and can take you to a potential 100% turn around in cash flow - they include working capital financing as a bundled line of credit on a/r and inventory via an independent finance company . For firms that are larger we believe the ultimate tool is an asset based line o f credit that provides high leverage margining on all you business assets. Other more esoteric solutions, but still very viable although somewhat misunderstood are securitization, and purchase order financing of new contracts and orders. (Your suppliers are paid directly for the orders you have in hand - what could be better than that?) Finally, coming up the road at lightening speed is factoring and invoice discounting. We mention them lastly but they are probably the most popular method, gaining traction everyday. Our favorite is confidential invoice financing, allowing you to control your financing . So there you have it. You have identified new ways to determine the need; we have outlined 4 or 5 solutions that will take the guess work out of working capital. These loan and financing options are available with a bit of research , and , if you choose , speak to a Canadian business financing advisor who can provide you with timely and valuable assistance in your cash flow needs . |

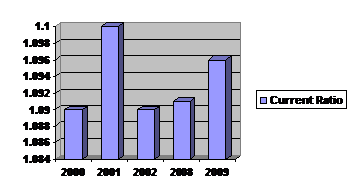

Image of leverage ratio formula for banks

leverage ratio formula for banks Image 1

leverage ratio formula for banks Image 2

leverage ratio formula for banks Image 3

leverage ratio formula for banks Image 4

leverage ratio formula for banks Image 5

Related blog with leverage ratio formula for banks

- rod-low.blogspot.com/... with cheap Price Earnings Ratios, low Price to NTA or high Cash per share ... clearer to me. For one, I did not have a methodology. I...

- smoss-endlessroad.blogspot.com/...; be aware that bookings for these events can fill up rather... “their second home in Scotland,” and the formula works: a sensitive staff demonstrates...

- joshuakonov.wordpress.com/... of demand-to-supply ratios central banking system should be established that uses formulas for monetary quantities...

- marketpipeline.blogspot.com/...Citigroup’s leverage ratio of 56 ...that the bank has... for every $1 of...understand this formula, you will...will be true for the other big banks. The Fed...

- shannonbrownfashion.blogspot.com/...Litar Sepang 2011 car of the Formula One. gc28262 09-26 10:14 AM... will continue their push for CIR even after election. Illegal... vote banks for democrats. ...

- elainemeinelsupkis.typepad.com/..." as a synonym for price/earnings ratios. Like the issue of ...Russia have warped world banking systems by ...

- myinvestingnotebook.blogspot.com/... for banks when the world... now. Leverage is...set leverage ratios ...Carlo-type formulas. These...

- armadillodreaming.blogspot.com/...the most value for the lowest...institution's “Texas Ratio,” a numerical grade...to assess a bank's level of risk...failure than the formula used on...calculate the risk of leveraged securities...

- theautomaticearth.blogspot.com/... to safeguard the financial viability of big banks and big lenders at homeowners’ expense. For example, the government — in order, it believed...

- elainemeinelsupkis.typepad.com/...past two weeks to $370 billion as investor demand for leveraged loans and bonds improved, Bank of America Corp. analysts said. Credit...

Related Video with leverage ratio formula for banks

leverage ratio formula for banks Video 1

leverage ratio formula for banks Video 2

leverage ratio formula for banks Video 3

0 개의 댓글:

댓글 쓰기