About 'debt to assets formula'|How to Reach $1 Million

When you are starting a home search, the first subject you must become familiar with is how to finance your purchase. Some people go straight to their local bank when seeking a home loan, some go to a mortgage broker who will be able to give them many different options as far as the type of loan they qualify for (at a fee of course). In this author's opinion, the best way to go is with a lender or broker who was referred to you by someone you trust. When you decide on someone, the next step is to find out if you really qualify. Credit Score, Income, and Debt The first question a mortgage lender will want to know is "what is your credit score?" (Tip: Most first time home buyers don't realize that they do not have to give every possible lender their social security number to get an estimate of their rates. If you know your credit score, you can just tell them what it is and let them give you the rates they have, then you can come back and give them your social to process the loan.) One of the biggest factors in financing a mortgage transaction is your credit score. Most lenders will not even look further into an application with a credit score lower than 580, while others will try to take advantage of bad credit customers with high priced products. Generally, customers with credit scores over 700 will have an easier time getting a fair mortgage loan. If your credit score is less than desirable, you may want to reconsider your decision to purchase a home at this time. Other factors lenders use to determine whether you are qualified for a loan are your income and debt load. How Much Home Can I Afford? So one of your first questions to tackle is "how much home can I afford?" The general rule is that your total monthly home costs should be no more than 28% of your gross monthly income. Monthly home costs include mortgage payment, taxes, insurance and any home repairs and upkeep. (Tip: You can find many mortgage payment calculators by doing a simple Internet search. Run some sample home prices through a mortgage calculator to figure out what your monthly mortgage would be at a common interest rate (around 7%) to decide how much home you really can afford.) You also need to find local information about your tax and insurance rates. Another important formula that most lenders will consider is your debt-to-income ratio. You generally do not want your total monthly debt to exceed 36% of your gross monthly income, or you may be in a trouble zone as far as trying to get your home purchase financed at a reasonable rate. Down Payment In the previous market, down payments were not always necessary. Mortgage brokers had many products that provided 100% financed loans to cover the entire loan. Nowadays, these types of loans are a thing of the past. You need a down payment of at least 10% of the purchase price of the home to receive financing, along with the closing costs which can be as high as $5,000. (Tip: Most sellers will provide what is called a "seller's assist," which is a percentage of the home purchase price, usually about 3% that will be put forth to help the buyer pay his or her closing costs. This "seller's assistance" is applied at the closing table.) What Kind of Mortgage Product is Best for My Situation? Once it is determined that your credit score, income, home price, and debt load is appropriate for your situation, you then have to make the decision with your lender on what kind of mortgage you will take -- a fixed loan, adjustable rate mortgage (ARM), The 30 year fixed loan is the most common and preferred--basically you will make a fixed payment every month for the next 360 months at a set rate. Some people vie for a 10, 15, or 20 year fixed loan at a higher monthly payment, the benefit being that you will be finished paying for your house in much less time compared to a 30 year fixed, and save thousands in interest. (Tip: Most people also make biweekly--instead of monthly--payments on their 30 year fixed mortgages which allows them to pay off their loan quicker and with much less interest cost.) The verdict is still out on adjustable rate mortgages. Some say it is a useful tool for prospective home owners who are looking to save some money, and some say it is a death trap for inexperienced home owners who know nothing about the way the economy moves. With adjustable rate mortgages you will pay a fixed rate over a certain number of years--namely three or five years--and then your rate will begin adjusting based on a formula set by the lender. In some cases after the three or five years is up, the rates and resulting payment can almost double (depending on the lender terms). Most lenders will recommend an adjustable rate only to people who only plan to live in their house for three years or less and want a low monthly payment. That way when they move and sell their house, they will have never been affected by an increasing rate. They also have the opportunity to refinance after the ARM's fixed time period is up, but refinancing can be difficult, impossible, and/or expensive for a homeowner in this situation. The proliferation of ARM's in the current American real estate market has played an important role in the increase in home foreclosures. One type of mortgage that most financial professionals agree you should avoid is any loan that includes a balloon payment. With this type of loan, you will pay a lower monthly payment over time, but then end up having to pay a large payment at the end of your loan that you most likely will not be able to afford. Also, unless you are a real estate investor, you should avoid interest only loans. With an interest only loan you will pay a lower monthly payment over a certain number of years, but all of the money paid will go straight to the lender's pocket--none will go toward paying off the principal, which is the actual bill for your house. The more principal you pay, the more equity you gain in your house. The interest only loan is only ideal for real estate investors because they usually don't plan on holding onto the house for very long. Stated income and stated assets loans are available to people who are self-employed and have good credit. With these products you do not have to prove or verify income or assets, and the lender is only considering your payment and credit history. The negative side of a stated income or asset loan is a slightly higher interest rate which could cost you thousands over time. Do Your Research Use the Internet for all it's worth. Search, research, and search again to gather as much information as possible before making a final decision on your real estate financing. Information is power, and ignorance is costly. With the proper research, questions, and parties involved in your transaction, financing your home can be a breeze. |

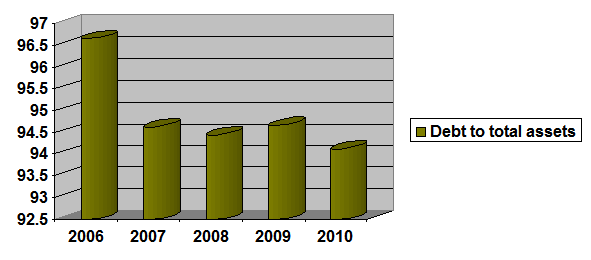

Image of debt to assets formula

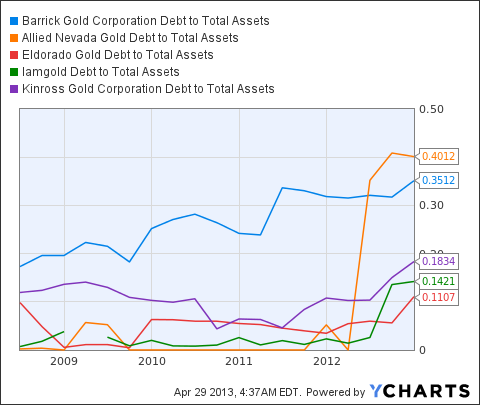

Related blog with debt to assets formula

- whattaboutbob.blogspot.com/...… which are critical to know if you want to buy these assets at the right price. Our formula for buying these assets safely. We believe...

- rod-low.blogspot.com/...I had to liquidate all my assets to meet the call. My world caved...1997. THE BUS TRIPS After my debts were paid off, I...

- debt-restructuring.blogspot.com/...glossary as a percentage of GDP. For Personal sometime measure to Bankruptcy Formula of Debt Ratio Debt ratio = Total Debt / Total Assets For example Company A Total asses = 1 million Total...

- anadventureinrealestate.wordpress.com/... to determine if they can loan on the asset. As an investor...relationship between cash flow and debt in your asset is...ultimate profitability Simple formula: I/M=R I-net ...

- barry-julie.blogspot.com/... important safe haven asset and an essential investment...America’s Per Capita Government Debt Worse Than Greece' / ...in the... / Jim Sinclair link here to listen http://www....

- theautomaticearth.blogspot.com/...the Treasury will do whatever is necessary to get your money. We can’t forecast exactly how... have defaulted on their debts in a more subtle way — by devaluing...

- tickergrail.blogspot.com/...in a year versus the dollar. We guess they were overlooking US exposure to European debt problems. The NYC legacy banks could lose $150 billion in credit default...

- coveredwriter.blogspot.com/.... The formula for ROE is: Financial Leverage = Assets / Shareholder Equity... to a company's indebtedness...ability to manage its debt. The following...

- www.freemoneyfinance.com/...amount of assets that you...value of the debts you owe. Another way to think of...as a formula it ...net worth" (assets minus ... to believe that... take debt into account...

- coobulldog.wordpress.com/... equal to the ratio above. So, another formula for ROE is: ROC x Leverage = ROE In...ROC) x 1.5 (Leverage) = 12%. By using debt to increase the amount of invested equity...

Related Video with debt to assets formula

debt to assets formula Video 1

debt to assets formula Video 2

debt to assets formula Video 3