About 'is debt ratio a percentage'|The debt-to-equity ratio as a fishing lure

When my husband and I refinanced our home loans early this year, we were told several times how our "credit utilization ratio" was on the high side. This came as a surprise since I consider myself to be rather shrewd when it comes to money matters. Credit utilization ratio is bank-speak for describing the ratio of what is owed on a credit card compared to your available credit line. This ratio is so important that it actually accounts for about 30% of a credit score. In our situation, our credit utilization ratio was high because instead of spreading our debt evenly over several cards, I put everything on the card with the lowest interest rate. While this makes sense in terms of saving on interest, it also throws off the ratio which impacts a credit score. Calculating the Credit Utilization Ratio Calculating the ratio is super simple. All that's required is a calculator and a copy of your current credit card statement. 1. Divide the current credit card balance by your limit, also known as the "credit line" . For example, if you have a $10,000 limit and have $4800 charged on the card, divide 4800 by 10,000 to come up with .48. 2. Multiple this number by 100 to convert the fraction into a percentage. Using this example .48 becomes 48%. Your credit utilization ratio on this particular credit card is then 48%. This exercise should be repeated on all your credit cards. What is a good range The FICO score looks at the credit utilization ratio in two different ways. They will calculate the ratio ~ like you just did ~ on each card to determine an overall score. Next, they'll add up all your credit card balances and divide this number by the total credit line for another score. If either of these numbers is too high, then your credit score is impacted negatively. When it comes to a good range for a credit utilization ratio, I've seen answers anywhere from 25% to 75% (read creditscoring.com to view what experts are saying.) According to my personal banker at Key Bank, the ideal credit utilization ratio in today's economy is between 30-40%. More by this author: How Credit Card Management can Impact a Home refinance. How to Get a Lower Interest Rate on a Credit Card |

Image of is debt ratio a percentage

is debt ratio a percentage Image 1

is debt ratio a percentage Image 2

is debt ratio a percentage Image 3

is debt ratio a percentage Image 4

is debt ratio a percentage Image 5

Related blog with is debt ratio a percentage

- nakakayamot.blogspot.com/...Indonesia 1.3%. Even as a percentage of the national budget, at... in Asia. Debt service payments...education spending is minimal, from 2.9% in 1990...

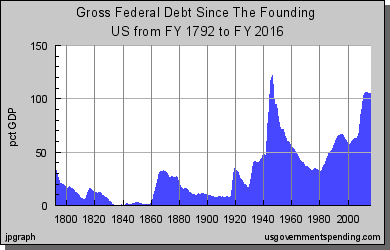

- poorrichards-blog.blogspot.com/... collective debt of all is the U.S. national debt. In a previous article , I discussed...believe it, the U.S. debt to GDP ratio has increased from...

- chastisement2013.wordpress.com/... collective debt of all is the U.S. national debt. In a previous article , I discussed...believe it, the U.S. debt to GDP ratio has increased from...

- viableopposition.blogspot.com/...an increase in debt-to-GDP by 20 to 30 percentage points over just a three year period...2011, this situation is not expected... their ratio of government revenue...

- debt-restructuring.blogspot.com/...amount of borrowing is called the national debt in glossary as a percentage of GDP. For Personal sometime...to Bankruptcy Formula of Debt Ratio Debt ratio = Total Debt / Total...

- citizen-gkar.blogspot.com/... — will run a deficit of 7.5 percent...year, and that net debt will be 75 percent of GDP...rise in the debt ratio. Suppose that we have... 3 percentage points off...

- viableopposition.blogspot.com/... debt-to-GDP ratio. Another impact on investor...this could function as a double-edged sword. As both debt and interest rates...risk. Because that risk is rising, the...

- westernbelizehappenings.blogspot.com/...health of an economy. It is the amount of national debt of a country as a percentage of its Gross Domestic Product (GDP). A low debt-to-GDP ratio indicates an...

- stockmarketcookbook.blogspot.com/...high debt/equity ratios are considered...with little to no debt especially in... analysis A recent CNBC guest... percentage gainers...

- tigersandfrontiers.blogspot.com/...course nothing like Greece - as a percentage - but be aware. The US is... the government debt, the third the development...who saw the Debt to GDP ratio deteriorate rapidly. What is...

Related Video with is debt ratio a percentage

is debt ratio a percentage Video 1

is debt ratio a percentage Video 2

is debt ratio a percentage Video 3

0 개의 댓글:

댓글 쓰기