About 'total debts to assets ratio'|Finance :: Leverage Ratio :: Debt-to-Equity Ratio

House of Representatives did not pass the Emergency Economic Stabilization Act bill today. Speaker Nancy Pelosi's untimely attack on Bush, with whom she cooperated in finalizing the draft during the weekend, made many Republicans grow cold feet. So today, when the bill was put vote, it failed to muster the required majority of 218. While 228 voted for it, 205 voted against it. For the market, it was almost a foregone conclusion that it would be passed, based on the bipartisan camaraderie shown in the weekend. And when the market's expectations were belied, it reacted violently. The Nasdaq and S&P 500's fell by the largest points since the 1987 Black Monday. Dow Jones Industrial Average's (DJIA) slide was surpassed only by the fall in the wake of the 9/11 attacks. Global markets too reacted by sliding 4-5% be it European or Asian markets. Even the fact that the Fed and nine other central banks pumped in $620 bln overnight to assure liquidity in the banking system, was not noticed. In UK,the mortgage lender Bradford & Bingley was nationalized. Their deposit taking branches are to be acquired by Spain's Bank Santander (STD). Belgium, Netherlands and Luxembourg took a combined $16 bln-stake of 49% in Fortis bank in a similar bail-out move. Iceland's Glitnir and Germany's Hypo also had money infusions from their respective governments. With European currencies falling, US dollar was the obvious beneficiary. Economic Data: Personal consumption expenditures (PCE) for the month of August - Total spending was unchanged though analyst forecast was for an increase of 2%. Personal income saw a meager increase of 0.5% but it was still higher than the consensus forecast of . September Farm Prices Index - fell by -1.3% from August. The Crop Index fell by -1.7% and the Livestock Index by -2.2%. Emergency Economic Stabilization Act Bill: Yes, that is the name of the Bush's financial recovery plan. Some of the clauses in the bill include: stricter regulatory oversight, limiting executive compensation, relief from foreclosure, purchasing illiquid assets using the $700 to be allocated in three tranches of $250, $100 and $350 under supervision. One important clause allows Fed to reward higher reserve holding banks by paying interest on that amount. CBOE Volatility Index (VIX) soared through nearly 12 points to 46.72. Oil fell by $-10.52 (-9.84%) to $96.37. Gold being the safe haven alternative in times like this, went up by $5.90 (0.66%) to $894.40. Government's Treasury bonds too are hot favorites now. Market indices: Dow went DOWN by -777.68 (-7.50%) to 10365.45 SP 500 DOWN by -106.59 (-9.63%) to 1106.42 Nasdaq DOWN by 199.61 (-10.06%) to 1983.73 NYSE : Daily volume: 1.86 bln A/D Ratio: 163 stocks advanced against 3109 declined 52-weeks Hi/Lo: Only 14 stocks attained new Highs while 970 stocks made it down to new Lows Nasdaq: Daily volume: 2.82 bln A/D Ratio: 414 stocks advanced against 2572 declined 52-week Hi/Lo: 21 stocks topped new Highs while 705 stocks set new Lows Market's fall today spread though all of its sectors. Bain Capital and Hellman & Friedman are acquiring Lehman Brother's troubled Neuberger Berman division for $2.15 bln. Japan's Mitsubishi UFJ (MTU) is to acquire a 20% stake in Morgan Stanley (MS) for $9 bln. Details of Citibank's acquisition of Wachovia business: Citigroup's total outlay in acquiring Wachovia is around $2.2 bln. That covers $700 bln operational assets and liabilities and $53 bln senior and subordinated debts. The FDIC will absorb any losses beyond $42 bln that arises out of the mortgage portfolio worth $312 bln which Citi assumed. Citi is allowed to issue $10 bln common stock to public. Company Results: Walgreen (WAG) produced quarterly earnings that conformed to the analyst's expectations. Circuit City's (CC) earnings were disappointing. Analyst's Ratings: Upgraded stocks are: BorgWarner Inc(BWA), Brookfield Infrastructure Partners (BIP), Canadian Imperial Bank of Commerce (CM), National City Corp (NCC), Nortel Networks Corp (NT), PMFG Inc (PMFG), Sovereign Bancorp (SOV), Take-Two Interactive Software (TTWO), Ticketmaster (TKTM) and Tellabs Inc (TLAB). Downgraded stocks include: Apple (AAPL), Brookline Bancorp (BRKL), Citrix Systems (CTXS), Comcast Corp (CMCSA), Coeur d'Alene Mines (CDE), Concur Technologies (CNQR), DISH Network (DISH), Freeport-McMoRan Copper & Gold (FCX), Motorola Inc (MOT), Research In Motion Ltd (RIMM), Sadia SA (SDA), Sprint Nextel Corp (S), Strategic Hotels & Resorts (BEE), Thor Industries (THO), Vasco Data Security International (VDSI) and Winnebago Industries (WGO). Credit is hard to come by for even banking institutions. So they are charging each other more than 4% for just an "overnite" loan. Where did all this trouble start? For a change, the answer comes from Canadian prime minister Harper (comments after the hyphens are mine) : 1. poor oversight - self-governed doesn't mean not governed. 2. cheap credit - lying about the applicant's income and capacity to return the loan 3. tax sops that give rise to housing bubbles - encouraging people to leverage too much 4. Ignoring early warning signs - yeah, anybody who had the nerve to warn was intimidated by accusations of conspiracy theory or doomsday prophesy Before calling our northern neighbor a traitor or backstabber, remember he is just telling the truth. Yes, truth can be unsavory and uncomfortable. |

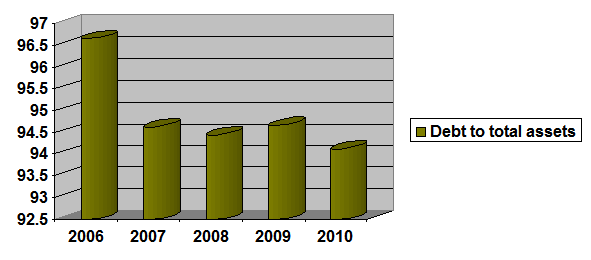

Image of total debts to assets ratio

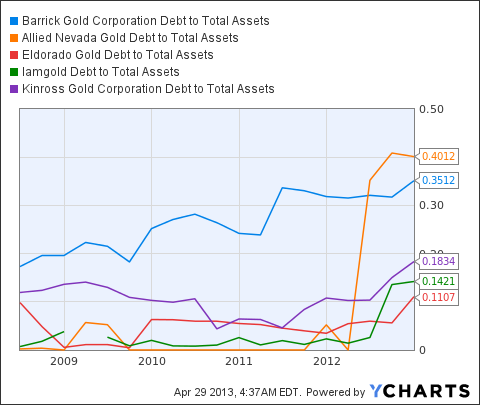

Related blog with total debts to assets ratio

- fredmba.blogspot.com/...debts with its assets. Debt-to-Assets = Total Liabilities /Total Assets The lower ratio the better as it means...

- datacenterlinks.blogspot.com/...Research article about the highest debt to asset ratio companies - which is where.... Investopedia defines Total Debt to Total Assets as: "A metric...

- harbinus.blogspot.com/...with no long term debt and a current ratio of 5:1 (short-term assets:short-term ... to offer energy ...CESV 70% of the total savings...

- debt-restructuring.blogspot.com/...another financial ratio that indicates what proportion of debt has relative to assets. The ratio of total debt and total assets. Debt ratio use in wide For the company to measure leverage of the...

- fredmba.blogspot.com/... using to finance its assets. Debt-to-Equity = Total Liabilities / Total Equity The lower ratio the better as it ...

- basunivesh.wordpress.com/...Assets Coverage Ratio :-This ratio will gauge how much liquid cash available to pay your debt. It may help you in... as Liquid Assets/Total Debt. I will consider...

- eboatloans.wordpress.com/...and below, your total debt including...payment needs to be below $650. That...your debt to income ratio. If you own property...and most of your assets are held...

- lesmaes.wordpress.com/... nominal GDP versus total household debt (ratio debt to GDP at the bottom): As you can see in...their debt growth with their cash-flow and asset growth. And on the cash-flow side, it...

- myinvestingnotes.blogspot.com/...investment than one with a minimal amount of debt on its books. The total debt to total assets ratio is used to determine how many of a company's assets...

- www.nakedcapitalism.com...Option 2, the disposable of public assets, none of the other options...impossible, one has to choose among bad options...politically explosive; it could trigger a debt crisis among the countries...

Total Debts To Assets Ratio - Blog Homepage Results

Related Video with total debts to assets ratio

total debts to assets ratio Video 1

total debts to assets ratio Video 2

total debts to assets ratio Video 3