About 'current ratio finance'|...market of aquaculture – fish farming. At the current price, HQSM is a bargain and in my view...price of 0.32, HQSM has a TTM P/E ratio of 8.7, but ex-items this rises...

Personal finance ratios are the thermometer used to measure your personal finance condition. And even if you think you know that temp, you could be wrong. Take your personal finance temperature by learning about ratios and the roles they play in helping you gauge your personal finance health. Personal Finance Ratio #1: Current Ratio To get this personal finance ratio just divide your total monetary assets by your total current liabilities (that IS NOT the total assets from your balance sheet and that is not your total liabilities, unless you broke your assets and liabilities out that way). What are current monetary assets? Your total personal finance current monetary assets are any cash monies available to you (cash on hand and cash in your checking or bank savings account) that you can access at a moments notice. Let's say for purposes of this example that this amount would be $200 in cash, $400 in checking, and $1,000 in savings. What are current liabilities? Your total personal finance current liabilities are the total current bills you owe right now. For example, if you owe rent (600), utilities (200) and a car payment (400) for the month of October, but you have already paid your credit card bill and your student loan bills for the month, it would just be the rent, utilities and auto payments that you would count. Calculating the current ratio in personal finance So if you calculate the personal finance current ratio based on the prior personal finance example, the numbers would look like this: $1,600 in assets divided by $1,200 in liabilities, which would equal a current ratio of 1.33 A current ratio of 2.0 is preferred, but as long as it isn't below 1.0 you are okay, as long as you are not dropping below that on a regular basis. If you are, you need to find out what is causing the ratio decrease and address it, since having a minimum of 1.0 ratio means you should be able to handle any small personal finance emergency that occurs. Personal Finance Ratio #2: Covering one month's living expenses ratio While the current ratio can give you a quick glance of where you stand in your personal finance health at one moment in time, the next ratio we discuss looks at what your personal finance health is on a monthly basis, since it takes into consideration the total monthly expenses an individual has--not just the ones left to be paid for the month. How to calculate your personal finance monthly living expense ratio You get this ratio number by dividing your monetary assets total by your total monthly living expenses. To aid you in calculating this ratio let's use the same data from the earlier personal finance example: $1,600 divided by $1,500 (I added a $200 student loan payment and $100 credit card payment to the $1,200 in liabilities we used above to arrive at the $1,500 number). Ratio Results: What do they mean? The ratio arrived at for this problem turns out to be 1.06 This means that this individual have enough cash assets (liquidity) available to them to pay at least one month's living expenses if some emergency were to occur and they needed to do so. Three additional personal finance ratios exist and are covered in the next personal finance article in this series (see Personal Finance and Ratios, part II). Additional personal finance articles in this series are shown below with links for easy access: Part 1: Personal Finance: Five Steps to a Better Financial Future http://www.associatedcontent.com/article/2304029/personal_finance_five_steps_to_a_better.html?cat=3 Part 2: Personal Finance and the Income Statement http://www.associatedcontent.com/article/2304299/personal_finance_and_the_income_statement.html?cat=3 Resource: Personal Finance: Turning Money into Wealth by Arthur J. Keown (5th edition) |

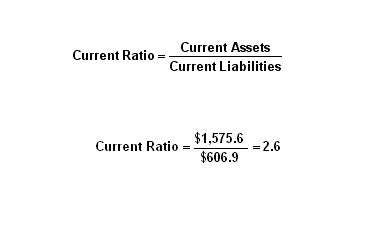

Image of current ratio finance

current ratio finance Image 1

current ratio finance Image 2

current ratio finance Image 3

current ratio finance Image 4

current ratio finance Image 5

Related blog with current ratio finance

- fredmba.blogspot.com/The current ratio help you to compare the current assets with the...can we reimburse the current liabilities). Current Ratio = Current Asset / Current Liabilities Note that...

- zacksman.wordpress.com/...S&P 500 is 1.82. BTW – the Medical sector has the best current ratio with a median of 2.68 while Finance still has the worst at 0.96. How to Use Screening...

- harbinus.blogspot.com/...market of aquaculture – fish farming. At the current price, HQSM is a bargain and in my view...price of 0.32, HQSM has a TTM P/E ratio of 8.7, but ex-items this rises...

- zacksman.wordpress.com/...of last year’s range.) (BTW – the Medical sector has the best current ratio with a median of 2.48, while Finance still has the worst at .98.) How to Use: Screening...

- labyrinthwalk.blogspot.com/... buffers. I can discuss frequencies and signal to noise ratios. With proper preparation I can even wax eloquent on encryption and error checking...

- superbenefitnews.wordpress.com/... many ways to access financing – but it is definitely not a good position to be in for too long. The current ratio also gives a sense of the...

- ivythesis.typepad.com/term_paper_topics/... nowadays. The current impacts on maritime...as well as cyclicality in the ratios and prices. This... from finance fluctuations like...

- fredmba.blogspot.com/The Quick Ratio (like the Current Ratio ) helps you to see...asset, the inventory and the current liabilities in the Balance Sheet . The quick ratio is good when over...

- thevalueatrisk.blogspot.com/...cash generated from financing activities (...sole purpose of meeting current debt obligations...Current Liabilities Ratio. To calculate the ratio, first...

- drparvezahmed.blogspot.com/...equity, profit sharing finance and markup transactions...interest based debt (current practices allow 33 percent debt-ratios). Sukuks , ...

Related Video with current ratio finance

current ratio finance Video 1

current ratio finance Video 2

current ratio finance Video 3

0 개의 댓글:

댓글 쓰기