About 'debt to earnings ratio calculator'|Where Do You Stand on These Financial Ratios

In This economy you probably already know how hard it can be for the majority of US citizens to keep a single dollar in their pocket. Especially when they are low income or have lost their jobs or have had their hours reduced. More people have to apply for unemployment and state assistance just to obtain food and some utility assistance. Food banks have seen a serge in the people that show up. Most of the food banks don't go by income. Some have you make it a requirement to validate your address with recent bill statements and ID's. Energy conservation is a big must with most people. On the other end of saving and/or obtaining money, more people, whether out of work or in need of more work, are having to travel long distances, or take up small jobs, under the table jobs, and more. Some of us don't have the luxury of looking for more work until further notice. I, myself, am 33 weeks pregnant. Looking for work will have to wait until a few months after I have my baby because I recently was fired from my job. Maybe, you're the person who wants to change jobs but knows that none in your area are really hiring and you know that sticking with your job is the smart choice. I myself am having to make adjustments in our budget. I recently turned off the cable (though my daughter doesn't seem to understand we can't watch her favorite shows for a while, she still asks), I hardly turn on the heater anymore, I unplug what I can at night to save energy, I wash my hair in the sink as well as my clothes, I cut out unlimited long distance on my land line, printed out grocery coupons even though I have WIC and food stamps (it's good for the name brands I like to use when I primarily buy reduced priced foods or store brand), my husband has had to convert to roll-you-owns for cigarettes, and I do try to make it to the food bank every week. Getting up that early isn't all that great, but it helps keep up the food in the house in additional to the WIC and food stamps I receive. Oh, and instead of renting movies, I borrow them from friends. I've sold many movies for extra cash and even turned in old and used cell phones. I got $76 for the cell phones. Luckily, I live in subsidized housing and my rent is based on my income. It helps. The apartment we are in right now isn't fancy, but it's what we got for the time being. In this article I am going to discuss ways to save money. Please, keep in mind that you can ask for advice from a financial counselor. This does cost money and if you can spare the change, it may be the best into what you may not know. My husband and I will have to take classes on financial planning and budgeting before we file for bankruptcy. We have no other choice but to do it with the amount of back bills we have and the low income we receive. So, here we go talking about money. Like you possibly haven't before, or have. Money saved from one area can be spent in another area. Or even better, the money can actually grow as a nest egg for the future. But regardless of the benefits of putting some money away, most people take a short-lived awareness in actually doing it. As young adults, they don't reflect much about retirement; then, as adults, credit card debt becomes a way of life. But the tough economic times that hit the U.S. in 2007 through 2009 (and still present) were a wake-up call for many people. Bringing about the public's consideration of saving to light. Make habitual saving a part of your life. Find out how to subjugate the first step: finding that extra money. 1. Convenience Stores: Countless people don't think about the mark-up they disburse for convenience store items. The money difference is huge because these stores don't procure food in the significant amounts that a regular grocery store does and also because they make you pay more for the convenience they endow with. Unless it's an urgent situation or if you don't have a better option, avoid frequenting at convenience stores. The quality you pay for expediency is not worth the unspecified convenience you get. For example, a Coke at a convenience store might cost you a dollar, while you can go to the grocery store and buy a 12 pack for $4. In visiting convenience stores regularly, the yearly funds of restricting these visits can be incredible. Make your own menu: Food is a main cost for nearly all families. The larger the family, the more elevated the food charge. Buying high-quality healthy fresh food can also be an expense. Every now and then families option to fast food, order out or going out to dinner because it's quicker and easier. Feasting out may be quicker and easier but it is more high-priced. Arranging mealtimes at home is a money investor in the long run. Getting the family caught up in developing a weekly menu saves money, time and the constant worry of coming to a decision about what to have for dinner every night. One of the complexities with cooking at home is that conventional working families don't have a lot of time when they get home to plan and cook a meal. Making a list of options is fun and it gets everyone drawn in. Each member of the family can have their night to decide on a meal. The menu becomes both the grocery inventory and the weekly planner. Take it to the grocery store with you when you shop and acquire groceries correspondingly. Announce it on the fridge so every morning you can see what's for dinner and take it out to defrost or know what you might need to collect for the meal on the way home from the grocery store. Eating at home is a long-standing way to conserve money with the added windfall of getting everyone involved with the meal. Do without the paper products: Just as food is a major expense for families, paper products and plastic ware are also pricey. There are some things that are compulsory such as paper towels and napkins (I use cloth versions). Purchasing plastic cups silverware and paper plates over time can put a mammoth kick in the teeth to your grocery account. Take a look at what you don't require and when you can cut out using throw away products on a repeated basis. Using these products is easier but also expensive. Getting out the paper for only those exclusive circumstances such as 4th of July and Birthday parties can save you a handful of money. Two years ago, Erin Chase was distressed to find new ways to save money. She had already cut back the utility bills to the stark minimum, and done everything else she could think of to save money. When, in spite of everything, there was not an adequate amount to go around, she eyeballed her grocery bill and prepared to work. As Erin followed a line of investigation on how to establish budgeted dinners, using the lowest-priced foods, she blogged about her encounters on her family website. In due course she went on to use the information to manufacture her own website, 5dollardinners.com. There she gave explanation on how to use the bargain basement priced foods obtainable, together with store brands and bulk purchases. Practiced sensibly, these good deal buys can make inexpensive family dinners. On the blog, Chase announces every shopping voyage she makes, in conjunction with the exceptional tips and tricks that help her. She offers recipes, stratagems, coupons, lectures and other helpful information for her audience. Several of Chase's recipes include $5 Tacos, Almost Cobb Salad, Broccoli Tuna Casserole and Maple Roasted Butternut Squash. All of her recipes can be made for $5 or less. The printable coupons on Erin's website come from coupons.com, a site that offers standard coupon deals on name brand products. When coupons are combined with sale items, the savings can be extraordinary. Tips and Tricks for $5 Dinners One of Erin's tricks is to minimize buying products for convenience. She often makes her own bread, buns and rolls because the cost is about half the price of store bought bakery items. (I do this, too.) She also advantageously plans her meals. By using leftovers resourcefully, she can get two meals from one purchase. A further way Chase saves money is to comb the Internet for store sales and coupons. Erin guesstimates that coupons alone can save a family $100 per month. Add to that a shopping list of on-sale items, plus keeping away from enticements and expediency foods, a family could accumulate another $150 every month. Over a year, a family with a $500 monthly food budget would cut the cost of dinner in half. Erin can go on a shopping expedition, prepared with coupons and flyers, and purchase a list of healthy foods for rock bottom prices. Chase doesn't hold up to using shortcuts to make reasonably priced dinners either. She uses fresh vegetables and other healthy foods. All of her meals are made from scratch. Out of her research, examinations, trials and tribulations grew a prosperity of information about saving money on groceries. After two years, this married mother of three drew together all the things she ascertained, the new recipes she had created, and some of the subject matter from her blog to construct "The $5 Dinner Mom Cookbook." When money gets taut the first thing to get sized back in a large amount of households is the grocery budget. This is comprehensible taking into consideration how much food the run of the mill family fritters away each month. You may have put into action some collective techniques of dropping your food costs like cutting coupons and buying store brand products. These are good ideas that work great to bring the cost of groceries down, nevertheless they are not the only way you can spread out your grocery dollars. Look at other tips that can save you even more money on your grocery operating cost. Break down bulk purchases- Buying in bulk will save you money if you shop smart. This is especially true when buying meat, which is notoriously expensive in the first place. Singles or small families can reap the benefits of buying meat in bulk if they know how to properly store their purchase when they arrive home. You only have a small window of time to cook meat while it is still fresh, which means you will have to freeze the rest to avoid spoilage. Do not throw the entire package in the freezer as is, or you will likely end up throwing it out months later in roughly the same condition. Store and freeze large bulk purchases in individual or dinner size servings which can be pulled from the freezer without thawing the entire package. Stock up in season- Buying produce out of season is another costly expense; one that you can avoid if you stock up when your favorite fruits and vegetables are in season. Avoid paying sky high prices during the off season by loading up the freezer directly from the farmer's market. Again, if you want to really use these items once they are frozen, take the time to store them in freezer safe containers or plastic bags in serving size portions. Later you can simply pull vegetables out for dinner or frozen fruit for a healthy snack. Make leftovers accessible- How many times have you or someone in your family gazed into the refrigerator as if waiting for a meal to appear. Store leftovers in clear, sealed containers for both food safety and convenience. Avoid waiting until morning to pack leftovers for lunch. Before cleaning up after dinner, pack leftovers in easy grab and go containers and you'll be more inclined to actually take it with you to work the next day. Eating "in" for lunch even a few times a week can save a lot of money which could be used for other purposes. Saving money doesn't essentially necessitate colossal forfeits or turning down yourself the things you hanker after. Saving money is every now and then as simple as taking what you have and devoting a few minutes to make certain it is used to the most excellent benefit. There is an superfluity of coupons to be had that can save you hundreds of dollars a month. Not just in Sunday's paper but in the free publications that you get delivered in your mail. The commercial flyers that are left at your doorstep offer dollars off for meals, merchant services and even home repair. Notwithstanding the accessibility of coupons and discounts on commodities and services, don't buy it if you don't need it or won't use it. Purchasing things that have little or no significance to you is not a way to save money in the long run. Many of the stores that you on a regular basis use, offer price cuts that may not be shout from the rooftops to the common community. That AAA card can be a huge savings to many people if they remember to pull it out at the checkout counter. From coffee shops to shoe stores to insurance discounts, AAA has hundreds of money saving gems just waiting to be cashed in. Computer stores often times have discounts for returning members. The smaller local businesses may be agreeable to discounts for valued customers. Local drug stores such as CVS and Walgreen's have member cards that bestow points or discounts on your purchase if you present the card when your purchase is being rung up. Forgetting your card could cost you several dollars more on your purchase. Ordering beverages along with a restaurant meal can boost your total expenses. Soft drinks also have one of the highest markups of any restaurant item. Consider a typical family of four that eats out twice a week at fast casual restaurants. Take up an average price of $1.50 for a fountain soft drink can total $12 a week, $48 a month, $624 a year. Just curtailing this one item from your meal could mean considerable savings that can go into something much more constructive, such as a retirement savings plan. Investing $624 at the market average of 9% a year every year and you would have almost $32,000 at the end of 20 years. Wow, I didn't know that I could save that much. Split it between my to oldest kids and they'd have a college semester paid by the time they were 18. WIC (Women, Infants, and Children). The WIC program provides free staple items like milk, bread, baby formula, yogurt, cereal, and cheese, and other food to pregnant women and new mothers. Also, now in most states you can get fruits and veggies that have to follow certain guidelines. Most of the time they can't be organically grown. I get $14 worth every month. Which isn't much for what I want, but it does help. Officially, The Special Supplemental Nutrition Program for Women, Infants, and Children is an support program synchronized by the federal government under Food and Nutrition Services (FNS). A division of the United States Department of Agriculture (USDA).Their stated mission is "To safeguard the health of low-income women, infants, and children up to age 5 who are at nutrition risk by providing nutritious foods to supplement diets, information on healthy eating, and referrals to health care." In many cases, for first time mothers, you have to take a nutrition class that tell you about how to eat while your pregnant. I had to do this back in Idaho, but after my first child I could opt for it. Here, in Wyoming these types of support are separated. You can take Cents-able Nutrition classes that not only inform you on healthy choices but on how to shop "cents"-ably. Customarily, ideal candidates for WIC are low-income and nutritionally at-risk pregnant women, breast-feeding women (Up to infant's first birthday) and non-breastfeeding postpartum mothers (Up to 6 months after birth of infant), and children ages 5 years and younger. The program is offered nationwide, but differs slightly by state and region. Examination has demonstrated that the assistance WIC has made available to the mothers and children in need that the program has concentrated infant mortality & fetal death rates, and enhanced growth rates of disadvantaged children. The majority of WIC state agencies and offices have beneficiaries receive checks or food devices to purchase only identifiable foods that provide the utmost nutritional reimbursements for a person's specific dietary needs (Example: Soy baby formula for a lactose intolerant infant). Some agencies have private warehouses and give the food directly to participants. WIC program food must have high daily value percentages in AT LEAST one of the following categories: Vitamin A, Vitamin C, Calcium, Protein, & Iron. At the grocery store, items that can be obtained through WIC checks display a sign that says "WIC approved item" on the shelf. Communal foods on the WIC program plan include eggs, milk, cheese, tuna, peas, carrots, peanut butter, fruit and vegetable juice, dried beans and fortified cereals. For infants that are not breastfed, infant formula can be gotten through the WIC program. I must state that in my case of getting milk through this program has been something I had to stand due to the fact that I need whole milk for my diet, by the WIC offered here in WY only lets me get 2%. I don't try to buy this item much on this program unless we need when we are low on our food stamps. Otherwise, I buy whole milk on food stamps. And I have experienced some drawbacks when it came to infant formula, both my children needed formula that their doctor suggested. And when I went to take in the medical note, the WIC office ignored it and gave me what they wanted stating that what conditions my kids had weren't really, "medical". I did talk to their director and told them that if they didn't follow an licensed professionals advice, then I'd have to quit the program because I had been initially told that if my child's needs changed, to bring in a medical note so that they (WIC) could asses the needs properly. Unfortunately, they refused and purposely lost the note I gave them just so they could say I never gave it to them when it was clearly seen from where I stood in my file. I want to share my experiences with the reading audience to let them know that sometimes the help agrues with you and to take any neccary action to make sure you aren't denied help according to medical advisment. I don't get these problem much now. In order to benefit from the program, you must meet four areas of eligibility: Categorical: You must you either be a woman (Pregnant, postpartum, or breastfeeding) or child less than 5 years of age. Father's can get this for there children if they are a single parent. Residential: Applicants must live in the State in which they apply. I have known of one person that did this illegally. She lived in one state and lied about her residency in another state. Truthfully, she was charged for trying to recieve both medical and nutritional help through two states and lied about her residency. She even carried to state ID's that were considered valid individualy but not together. Income: You have to make less than a certain amount of overall income. You are automatically eligible in the income area if you receive Medicaid or other medical benefits, are on food stamps, receive benefits from TANF (Temporary assistance for needy families), or any other approved state agency Nutrition Risk: Your nutritional risk will be evaluated during an appointment by any number of different standards. For income eligibility, please visit http://billeater.com/tips/wic-receiving-food-assistance and http://www.fns.usda.gov/wic/howtoapply/incomeguidelines08-09.htm To start the application process, you need to arrange an scheduled time with your local office. Once you done so, employees at the offices will assist you with the rest of the application course of action. Do bear in mind that sometimes the WIC agencies do not have enough money to assist everybody that is eligible, and you may be placed on a waiting list, but this shouldn't be a huge problem because WIC is a temporary short term program. For list of WIC phone numbers to call for each state http://billeater.com/tips/wic-receiving-food-assistance 2. Cell Phone Plans: Take the time to examine your monthly cell phone bill - you may be paying more than you need to. If you are utilizing a reduced amount of minutes than your monthly plan consents to, substitute to a lower-rate plan. If you are using additional minutes than your monthly allocation, then advance to a higher minute plan. Beforehand, sit down with a inventory of your cell phone company's offerings and put each side by side to establish which plan makes available the most worth centered on your needs. Nearly all cell phone companies charge 40 to 50 cents per supplementary minute, so going over your permitted minutes by 100 minutes one month will cost you $40 to $50. You ought to scrutinize from beginning to end, your cell phone plan for further features such as text messaging and mobile internet. If you aren't using these features, get clear of them. It by no means offends to inquire if your existing service providers for your cell phone, electric company, credit card, cable provider or insurance organizations have an amount of distinctive service packages that can be particularly custom-made to you. Many corporations may have non-advertised discounts or packages that could save you money and better fit your needs. The price tag of phone service has intensified in recent years with new add-on features and packaging with other services. Such as Internet access and cable TV. There is also help for people who qualify for low-income assistance. Over 1,500 telephone companies in the United States and its territories participate in the Federal Low-Income program. They are selected as Eligible Telecommunications Carriers (ETCs) by their state commission or the FCC. The telephone carrier may require you to pay a deposit before setting up telephone service. However, if you agree to limit long distance service on your phone, many service providers will waive the deposit for program participants. This is called "toll limitation" or "toll blocking." Even with this toll-blocking program, you will still be able to place long-distance calls using a pre-paid calling card. The Link-Up America and Lifeline Assistance programs provide markdowns on initial installation or activation fees for telephone service at the primary residence, as well as on basic monthly service. Link-Up America helps consumers with telephone installation costs. Lifeline provides discounts on monthly telephone service. This agenda pays one-half of the preliminary installation fee for a traditional wire line telephone (up to a maximum or $30), or half the activation fee for a wireless telephone for a principal residence. Participants may pay their portion of these fees on an interest-free regular payment plan. Residents of Native American Indian and Alaska Native tribal communities may qualify for up to an additional $70.00 in support. Lifeline Assistance: This program provides a discount of at least $10.00 per month on basic monthly residential service (rates vary by state). Native Americans and Alaskan tribe members may qualify for an additional $25.00 discount. Some states provide more discounts to make local telephone service even more affordable. To determine if your state offers these additional discounts, contact your state's public utility commission (go to www.naruc.org/commissions.cfm for this information). Everyone is looking to cut costs these days. Many people are giving up landline phones and departing completely to a cell plan. For more information or for help determining if you qualify for these programs, visit the resource links below or call your local telephone company. www.lifelinesupport.org www.lifeline.gov www.universalservice.org www.naruc.org/commissions.cfm 3. Unnecessary Bank and Credit Card Fees: More than enough people unsuspectingly disburse a lot to their banks in the appearance of fees. Particular banks rate ATM fees for using another bank's ATM. These can be as excessive as $5 a piece. Amounting to a 25% one-time fee for a $20 withdrawal. You would be better off using a credit card to make the purchase. Pore over the policies prevailing your checking and savings accounts. Numerous people have accounts with a predetermined number of withdrawals and deposits per month. You would be better off with an account preservation fee of $10 a month than getting afflicted with two or three dissimilar fees a month. Also, take into account merging bank accounts. As frequently one account with a superior minimum can remove numerous fees that might otherwise be situated. Unless you have a poor credit history, there is no motivation to pay yearly credit card fees. A multitude of Visa, MasterCard and Discover cards have no annual fee, in spite of that, many people pay up to $100 a year for the pleasure of possessing a credit card. If you're ultra-wealthy, then cream of the crop card-holders of an elite-level get privileged benefits. Most people should not be financing annual credit card fees. Make sure you make a payment on time every month, even if it's the minimum. Many credit cards charge $39 monthly late fee charges which accumulates interest along with your existing remainder. 4. Magazines: Reflect on getting an annual subscription. Even if you don't want the magazine every month, a couple of issues at the newsstand are enough to cover the entire annual subscription. A 26-issue subscription to Forbes Magazine will cost you less than $25, while one issue at the newsstand costs $5. 5. Daycare: Expensive, recurrently too expensive. Parents with more than one young child can find themselves paying $400 a week or more just so they can go to work. For many parents it's cheaper to stay home than it is to work. So, if I were to take into account that the number of children between me and my husband currently is 5 (until baby is due), then that's $2000 a week for child care. I would definitely have to get child care assistance from the state. Which for here in Wyoming I think could pay at most $0.50 an hour per child. At most that would mean I'd pay $0.50 an hour while the state helps pay for the rest. Equaling $400 a month. The same $400 weekly average for one child. But each state is different in their child care assistance program. And usually you can obtain a certified list that the state has for your area consisting of child care providers that are licensed. Then you have to go through the whole ordeal in interviewing each care taker that may be interested in taking in your child. Leading to which one will agree to the job. It's a process. And in my town, it's near impossible to not only find openings, but to find someone I feel comfortable with. I haven't used a sitter since I moved here. My husband and I work out hours between work. Though that wont be an issue now since I lost my job. It gives him a chance to actually get a second or replacement job to keep the home intact. But it doesn't have to be that way. You can get together with other parents and arrange a parenting cooperative. Also known as a child swap. A different parent cares for the children each day of the week. I hear some churches do this, too. There are countless varieties of a child swap agreement. It can be good for stay at home parent who just needs one day to themselves, or any full-time worker who can put together for a bursting workweek. Work at home parents can also benefit. Part time workers can swap two days for two with another mother as well. Parenting coops work best in neighborhoods or at least in the same town, but they can be arranged with family members and others who are judiciously nearby. Even taking advantage of a cooperative one day per week can save a family $100 or more that week. Parents can swap for just one day off with one other parent, or have a group of five parents each taking the children one day per week, as long as each parent only has one child. Parenting cooperatives with more than five young children are not recommended. Remember that the recommended caregiver to child ratio at a daycare center is 5 young children to each caregiver or 3 infants to a caregiver. You should only take on an infant with a small group of children. This wouldn't work for me. I am very nervous about other people taking care of my children unless it was family that I can trust to oblige my requests in particular care for each child. I'm immensely picky. A child swap is easiest to arrange with a parent you are already friends with. Even more so if your collective kids are friends with each other as well. Relatives are also excellent choices because you already know and trust them. Sites like DaycareTrade.com help parents find other parents who wish to participate in a cooperative parenting organization. Contributors are other parents who are also looking to put their children in a safe and reasonably priced daycare arrangement. While the site does not screen the other members, they advocate parents do comprehensive research just as if they were taking into service a nanny. Ask for character references and talk to the other parent's employer before entrusting your children to someone else. You also need to be ready to you're your own references to the other parent. When making arrangements for a parenting coop, make sure you ask some imperative questions early. Get the other parent's phone number, address, work phone and at least one other reference you can talk to. Make it clear when you will be available to watch the children and during what time frame. Be clear in your mind that the other parent can fit into your childcare time schedule as well. Chat about any special needs of the children early so that there are no disclosures later on. If you are still unnerving with the other parent after checking references, meet in a park or for lunch to see how the kids do together. Watch the other person's parenting skills to see how well it fits in with your own parenting style. Make the first swap days into play dates, so you can both run through time with the kids and get to know each other and the children. The acquaintances you bring into being on these days can set the stage for a long friendship that is constructive to both parents. Commit to memory that the other parent is just as nervous about you as you are about him or her. When you are mutually at ease with the arrangement, you may be able to contemplate finding other parents to consist of in the cooperative. Sift through each prospective parent with awareness and take the same steps you would to check out any caregiver you would be making an allowance for your child. By taking advantage of a cooperative arrangement, you can $10,000 or more per year in childcare expenses. Family life can get expensive. After make financial arrangements for the fundamental expenses such as meals, electricity, rent and telephone most families usually have diminutive change leftover for the fun stuff. Saving money can be easy when the whole family helps out spending time together and saving money doing it. If saving money is done in small steps it usually will have an insignificant impression on the overall eminence of life. Additional tips on saving money and being money wise. Many Americans were apprehensive to see the end of 2009. It was a year full of bad economic and financial news. (Not, that I can't say the same about this year considering how it is so far.)There will be new rules and chances made accessible in 2010 for Americans to build up their financial lives. Each year millions of people make New Year's resolutions eager to progress some facet of their life. One of the top ten resolutions each year is to get out of debt and/or save more money. This year extra people are conscious of the need to improve their individual finances. Building your savings is one of the best ways to guarantee financial self-sufficiency and steer clear of future debt. To productively grow your savings you must know how and where to commencement the course of action. Online savings accounts recommence to escalate in popularity and for good explanation. In many cases online banks tender expediency and terms that are better than those found at a brick and mortar bank. Here we look at ways to find the superlative online savings account. Assess your needs- Before you begin your hunt, evaluate your banking needs and write down your savings goals. This information will help you when it comes time to weigh against dissimilar accounts. Online savings accounts can be a impressive tool for those just starting out or even for people who have time-honored savings accounts. If you have extensive assets you want to compare both online savings accounts and those offered by more long-established banks as some banks offer better stipulations for accounts with a higher balance. Compare rates- As formerly pointed out, one of the advantage of using an online savings account is the augmented amount of money you can earn with higher interest rates. Each account propositions assorted terms and circumstances, for that reason you must prudently compare all banks and the individual accounts offered by each to become aware of the one that best agrees with your financial desires. Compare features- The best online savings account will offer not only cutthroat rates but also other features which make your life accessible. You are in particularly looking for how long it takes to relocate money in and out of your account. When you come right down to it or not you have right to use a substantial location should you need in-person assistance and what other selections are available away from the customary savings account. Do your homework- Ahead of depositing any money into an online savings account take the time to research the institution. Avoid problems in the future by making sure the bank is FDIC insured. There are a number of well-liked websites that compare and review online savings accounts. Current or previous account holders may remark on these sites offering personal knowledge which can help you decide if a prospective bank is right for you. Online savings accounts are good for more than just saving money. You can also open fused accounts where you can not only save money but also pay bills like you would from a conventional checking account. In spite of which bank or account you choose, know that making the endeavor to save money today will expand your personal finances in the months and years to come. Patrons today are becoming more responsive of the fact that banks and credit card companies are, in actuality, a business. A money making business no less, that is at the mercy of their clients to earn big bucks. Banks make their money off of the goods and services they make available for consumers as well as the interest, fees and penalties they charge for any indiscretion made by unsuspecting customers. With that in mind, we all need to use banks and many of the services they offer. Reflect on the following tips to trim down your banking costs: Stop paying preventable fees and penalties- There are an abundance of small fees that many people freely pay for the handiness of saving time. A few dollars here and there doesn't seem like much, but it does add up. In fact, banks are put their faith in on those fees to append millions to their bottom line each year. To avoid paying fees and penalties you must take the measure to conscientiously be familiar with the terms and policies of each account you have with every bank. What is free at one bank may cost extra at another. ATM fees and overdraft penalties are well-known for running down your bank account and filling the profits of the bank. By carefully budgeting and paying consideration to when and where you need cash, you can reduce the need to pay ATM fees and overdraft penalties. Borrow with caution- Even though more people are trying to maneuver away from debt, there are some state of affairs where you merely do not have the cash on hand to make a purchase. Perchance you are buying a home or a new automobile. In a large amount of cases you will have to borrow money from a lender to finance these purchases. Do not make thoughtless pronouncements and pass up putting your signature on any indenture that you do not completely understand. At whatever time achievable, pay as much cash down on these purchases to reduce the amount of money on loan, therefore reducing the interest paid over the life of the loan. Shop around- With accurately thousands of alternatives out there today, you no longer have to establish yourself for the bank branch to be found in your hometown. While there are specified advantages to having a local brick and mortar building in which to carry out your banking business, you need not put all your eggs in one basket. Virtual banks are at this time offering better rates on savings vehicles and in many cases a credit union might offer better benefits to affiliates. Take advantage of this competitive industry by follow a line of investigation on all of your selections and choosing the right bank for your financial needs. By improving your banking practices and paying intimate attention to the contracts you enter, you position a better chance of holding on to your own money versus making a contribution to the bank's revenue. Now, spend a couple hours and go over the above categories along with any other frequent practices you may have built up over the years. The time will be well used up as it could mean hundreds of dollars of returning annual savings. Gather every financial statement you can. This includes bank statements, investment accounts, recent utility bills and any information on the subject of a source of income or expense. The key for this procedure is to establish a monthly arithmetic mean so the more information you can dig up the better. Document all of your causes of income. If you are self-employed or have any outside sources of income be sure to record these as well. If your income is in the form of a regular paycheck where taxes are consequentially withheld then using the net income, or take home pay, amount is fine. Record this full amount of income as a monthly amount. Create a inventory of monthly expenses. Write down all the anticipated operating costs you plan on incurring over the month. This consists of mortgage payments, car payments, auto insurance, groceries, utilities, entertainment, dry cleaning, auto insurance, retirement or college savings and fundamentally everything you spend money on. Separate expenses into two categories: fixed and variable. Fixed expenses are those that stay more or less the same each month and are obligatory parts of your way of living. They incorporate everyday expenditures such as your mortgage or rent, car payments, cable and/or internet service, trash pickup, credit card payments and so on. These expenses for the most part are indispensable nevertheless not likely to change in the budget. Variable expenses are the type that will change from month to month and include items such as groceries, gasoline, entertainment, eating out and gifts to name a few. This category will be imperative when making modifications. Summarize your monthly income and monthly expenses. If your end consequence shows more income than expenses you are off to a good beginning. This means you can prioritize this surplus to matters of your budget such as retirement savings or paying more on credit cards to do away with that debt more rapidly. If you are viewing an elevated expense column than income it means some changes will have to be made. Make modifications to expenses. If you have precisely acknowledged and listed all of your expenses the fundamental goal would be to have your income and expense columns to be one and the same. This necessitates that all of your income is comprised for and budgeted for a detailed expense. If you are in a circumstance where expenses are higher than income, you should look at your variable expenses to find areas to restrict. Since these expenses are more often than not crucial, it should be uncomplicated to shave a few dollars in a few areas to bring you closer to your income. Make another study of your monthly budget . It is imperative to assess your budget on a customary basis to make sure you are remaining on track. After the first month take a minute to sit down and put side by side the definite expenses versus what you had created in the budget. This will show you where you did well and where you may need to develop. When arranging for large purchases, make sure you include not only the fixed, acknowledged expenses, but also the variable, unspecified expenses. The key is to calculate approximately these purchases and break down your responsibility into monthly increments, then make sure you're placing in reserve those amounts each month. With the accepted envelope budgeting approach (I use this techinique to keep track of my expenses in individual categories so that if inquired about it by government or whatnot, I can show evidence), you would set aside $100 into your Car Insurance envelope each month for six months if your 6-month premium is $600. Back in the days of pencil and paper, following these types of transactions was do-able, just not pleasant. In these days of computers, software built with budgeting in mind makes managing large purchases effortless. You merely budget that $100 into your Car Insurance category in the software, and it trails the balance collection for you. You would never not pay your electricity bill, rent, or gas bill. But, we see a lot of people not paying themselves. The key is to be concerned with your own personal savings as a justifiable top-line expense. You want to pay yourself first, before you set aside resources for your other requirements. If you're using software such as YNAB or Quicken, you can create a Savings Expense category and record all steady flows to savings as an expense. Doing this also lets you run significant reports. An central primary in budgeting is to make sure you give every dollar a job. You must make sure every dollar is held responsible. This does NOT mean that you're required to only spend the bare minimum achievable in every single spending category. If you need more elasticity in your budget, then you should put together that into your budget. Budgeting is planning. You can arrange some cushion into your budget so you don't emotionally rise and fall on every over or under in your spending categories. If you are using personal budget software, make sure it permits you to play down your budgeted amounts. What you don't want is to be controlled in how you designate your dollars jobs just because the software won't let you make a a small amount of modifications. Adjustments are a part of life. If you are not making alterations, you are most likely not budgeting. A large amount of the time when people learn how to budget, and put into operation these basic ethics in their life, they find they have "more money" than they did until that time. The appearance of extra money is attributed to the piece of information that their attentiveness has changed, and that they are being more discriminatory about where they are spending their money. On the other hand, people become conscious that they have being living outside their resources. In this matter, you are confronted with two options with the ability to choose both. Option number one: Cut back. Weigh up flexible spending such as subscriptions, eating out, entertainment, etc. If the open expenses are not permitting any room to move, it's time to calculate superior obligations such as the car you are driving and where you are living. Some data analysis can go a long ways here. Run an account showing all of your category expenses and you'll promptly see what may be reduced. The YNAB Software lets you run several reports that show you your categories as piled bar charts, or pie charts. Use budgeting software to show where you may need to make corrections. Whether you in point of fact make those adjustments is still up to you. Your second option in facing your budget certainty is much more agreeable. You can dynamically search for ways to proliferate your income. If the expenses are momentarily higher, you can look for transitory ways to increase your funds by selling things on eBay, working some overtime, or picking up some side jobs. If you're looking at an expense situation that is longer-term, you may contemplate these short-term tactics, along with some longer-term tactics such as job searching, education, etc. One of the leading exertions on a budget comes from a person's debt burden. If you can pay down your debt, your monthly cash flow condition will improve immeasurably. Consider executing the debt snowball method, where you pay an optional extra with regard to your uppermost interest rate debt, and minimums on all others. Once that debt is paid down, you roll its minimum and all extra funds toward the debt with the next highest interest rate. You may consider using a debt reduction calculator to do all of these calculations for you. One of the immense ways to get help when learning how to budget, and then applying those procedures, is to find a support group. Whether it be local or online. Finding like-minded people all motivated toward the same goals can be very rousing. There are some positive trends and opportunities to look forward to in 2010. Home Buyer Tax Credit: You've heard much of this in the AC community. First time homeowners with an income of no more than $75,000 or $150,000 per couple can still qualify for the 2009 $8,000 homebuyer tax credit. You must be in contract by April 1st, and close the property by June 30, 2010. If you've owned the same home for 5 consecutive years out of the previous 8, you are eligible for a tax credit up to $6,500 for homes sold after November 6th, 2009 and on or before April 30th, 2010. Credit Card Act: Consumers have been struggling under interest rate hikes, and increasing bank fees. Slated to go into effect on February 22, 2010 the Credit Car Act will offer consumers relief and new protections in 2010. The Act will also require clear disclosure of fee changes, protect young consumers and college students, and regulate gift cards. Cash is King in 2010: With credit card debt mounting on many Americans, customers are looking to reduce or give up completely the plastic and turn to cash instead. As of September 2009 Americans owed $917 billion in revolving credit card debt. During the 2009 holiday shopping season, USA Today reported that 71% of consumers planned to use cash or debit cards instead of credit cards as their primary method of purchasing gifts. The trend is likely to continue as consumers continue the new frugal lifestyle. Community Banking: 2009 was the year of the bank bailout. Americans were angry over the perceived injustice of the bailouts for mega banks that were raising fees and reducing lending. 2010 could be the year of the local community bank. A 2010 grass roots effort called Move Your Money is an initiative to change the finical landscape away from Wall Street to Main Street and encourage consumers to put some of their money in to community banks. The Independent Community Bankers of American describe the community banks goal to "focus attention on the needs of local families, business and farmers." And "channel most of their loans to the neighborhoods where their depositors live and work, helping to keep local communities vibrant and growing." If you make a decision that you are going to implement noteworthy amendments in the family budget or spending patters, its paramount to have a discussion about it with the complete family. Get the kids on board and ask them to help out. Tell the specific things that you need their help with in an effort to save money. This often works if there is an end goal in sight. Cut out going to the movies every week for and plan to take a trip to the theme park in the summer. Saving towards a goal is one way to motivate the family to have a reason to save. I saw on one of those television mommy swaps a family that was substituted a mother who had to explain that while it's a good idea to have the whole family save money and work towards a yearly family vacation, that the workings of it for the family she was substituted for, was on a immensely strict set of rules and regulations. So much so that the kids felt that they could never do what they wanted with their own allowance. And that even with an allowance, they were literally made to give a portion of their earnings to put toward a family vacation that they may or may not have agreed on with their mother. The sole decision maker of the family budget. Weigh the reimbursements of shopping on-line. Shopping on-line can be a vast time saver but not always a money saver. Typically the more you buy the lower the shipping charges. You should each time consider if shopping on line will save you money in the long run, in particular when you are just picking up one or two things on-line. While on-line shopping can be well-situated and quick, it may not always be beneficial to the wallet. Unemployment has hiked to just under 10% consistent to recent numbers. Experts forecast that number to continue or grow to some extent. 2010 will be the year to look at mounting new skills to make yourself more worthwhile to your existing employer or more marketable if you are looking for a job. Hot certifications include project management, search engine optimization, and Word Press for blogs. If your thinking about state assistance, here's some information: Eligibility: There are both state-supported and federal versions of each program. State program criteria vary by state, but states that do not offer their own program adhere to federal guidelines. Federal criteria requires that participants have income at or below 135% of the Federal Poverty Guidelines, or participate in one of the following programs: Medicaid Food Stamps Supplemental Security Income (SSI) Federal Public Housing Assistance (Section 8) Low-Income Home Energy Assistance Program (LIHEAP) Temporary Assistance to Needy Families) TANF The National School Free Lunch Program For household income to be at or below 135% of the Federal Poverty Guidelines, total income for the household must not be more than what is set by each individual state regarding family size. Alaska and Hawaii may have higher income limits. For each additional person in the household above eight people, add $5,049 for families living in the lower 48 states and Washington D.C.; $6,318 per additional person in Alaska, and $5,805 per additional person in Hawaii. This is among the few of many ways to save money in this economy. Best of luck to you and yours. http://finance.yahoo.com/banking-budgeting/article/108573/top-6-mindless-money-wasters?mod=bb-budgeting http://financialplan.about.com/od/budgetingyourmoney/ht/createbudget.htm http://www.vertex42.com/ExcelArticles/how-to-budget.html http://billeater.com/tips/2010-personal-finance-essentials-what-you-need-know http://billeater.com/tips/how-find-best-online-savings-account http://billeater.com/tips/money-saving-banking-tips http://billeater.com/tips/save-thousands-childcare-with-a-parenting-coop http://billeater.com/tips/money-savers-entire-family http://billeater.com/tips/5-dollar-dinner-mom-a-few-her-secrets http://billeater.com/tips/food-storage-tips-save-money http://billeater.com/tips/simple-money-saving-tips-still-work http://billeater.com/tips/low-income-help-with-your-home-phone http://billeater.com/tips/wic-receiving-food-assistance |

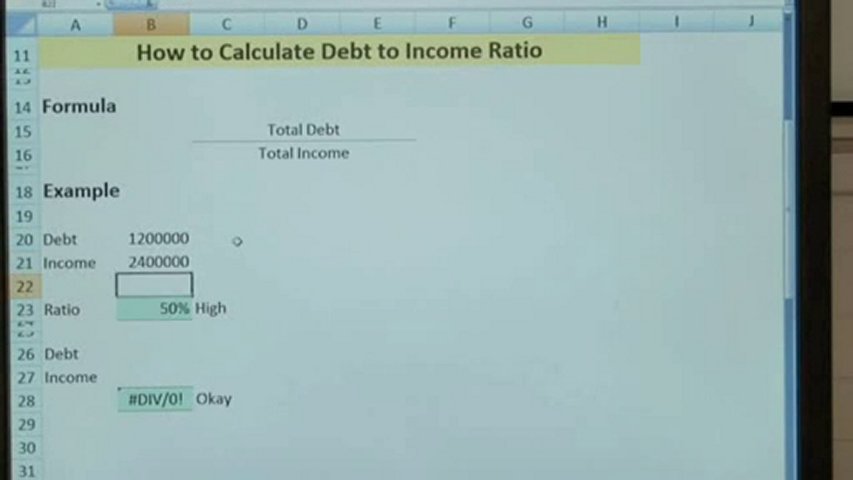

Image of debt to earnings ratio calculator

debt to earnings ratio calculator Image 1

debt to earnings ratio calculator Image 2

debt to earnings ratio calculator Image 3

debt to earnings ratio calculator Image 4

debt to earnings ratio calculator Image 5

Related blog with debt to earnings ratio calculator

- theautomaticearth.blogspot.com/...and the fact that Asian earnings are still expected to grow by an unrealistic...and hence high external debt to GDP ratios. So they are dependent...

- tennesseeindependent.blogspot.com/...presentation, a rise in the portfolio size from just $136M in 2006 to over $3.7B, financed with a continuous stream of equity and debt offerings; yet net asset value per share has...

- www.freemoneyfinance.com/...total earnings to net worth...your debts ...Fund Ratio (Retirement...ratios/calculators, etc...card debt ...acceptable to ...

- notesonthefront.typepad.com/politicaleconomy/...insolvency poverty. Our rulers, giving deep consideration to the problems posed by household debt, have designed a solution. Does it write down the debt...

- cashmoneylife.com/...can be sure of what my earnings will consistently be. After all, I don’t have to pay off my student loan.... Debt-to-Income ratio: This is part...

- whereiszemoola.blogspot.com/...have increased its debt. Ouch! Yesterday IOI Corp announced its earnings. Quarterly rpt on ... On Ringgit Fall To Two Year Low ) , I was...

- fischerfinancial.wordpress.com/... the inflation calculator of the U.S. Bureau of... power, 2000 to 2010: http://bit.ly/BLScalc...in March that the price/earnings ratio was too high...

- www.freemoneyfinance.com/...aggressively for appreciation. Your debt load ratio (total liabilities ... most of your debt. If you are trying hard to pay off your mortgage ahead of schedule...

- keywestchronicle.blogspot.com/...the point where the middle class can't afford houses or buries itself in debt to own them. My inner capitalist is too busy watching shares...

- www.freemoneyfinance.com/...worth each year. Contact us or visit our website to receive a free copy...a more relevant measure in my estimation.) Debt Load ratio (Total Liabilities divided...

Related Video with debt to earnings ratio calculator

debt to earnings ratio calculator Video 1

debt to earnings ratio calculator Video 2

debt to earnings ratio calculator Video 3

0 개의 댓글:

댓글 쓰기