About 'monthly debt calculator'|A Debt Reduction Calculator

Whether you are looking for your first house or looking to move to a different house it can be hard to decide what you can afford to spend for your new home. Careful consideration is important because moving into a house that is too expensive may leave you more vulnerable to a future foreclosure. While not investing enough in your new home may leave you with too small a home, as well as diminishing your investment return when you eventually sell your house. Important considerations when calculating how much you can afford when buying a new house include income, property taxes, down payment, your credit situation, and your other savings needs. Before you begin searching for a new house it is best to figure out the maximum monthly payment you can afford. Do not wait and let a realtor or lender calculate this for you, they will likely use a generic calculation that may not take into effect all aspects of your situation. The standard calculator used is that your house payment should be roughly 25 to 33 percent of your monthly salary. This calculation, however, can represent a a range of several hundred dollars in monthly payments. Whether you fit into the upper or lower end of the range depends on a number of factors the realtor or lender will not necessarily take into account. Now granted, lenders should not be putting you in a house you cannot afford, but as the sub-prime mortgage crisis and subsequent flood of foreclosures proved, lenders do not always do what is best for borrowers. For this reason it is crucial to calculate the maximum house payment you can afford and stick to it when you look at homes. Some reasons to use the lower end of the range include the size of your family and needing to save for college, your age and needing to save for retirement, the amount of outstanding debt you already have, and the other costs associated with home ownership. For instance, living in a place with higher property taxes or not having money for a substantial down payment and having to buy mortgage insurance should lead you toward an affordable monthly payment toward the bottom of the scale. In addition, you need to include all expenses when calculating a monthly payment including things like increased utility payments, maintenance and upkeep costs, and homeowners insurance. Also, keep in mind that you want to buy a house where you can afford the payment based on a thirty-year fixed mortgage. Again, this is a hard lesson many homeowners learned at the cost of foreclosure over the last few years. If you cannot afford the payment with a thirty year fixed mortgage, you cannot afford the house. Do not let yourself be talked into a balloon payment, interest only mortgage or adjustable rate mortgage, recent history has shown that very few people have the fiscal discipline to save for those future huge payments or the financial understanding to take advantage of these different mortgage products. Buying a house, whether its your first home purchase or you want to upgrade can be very exciting. It's tempting to look for that dream house and forget about fiscal responsibility. In the long run, however, you are much more likely to be happy with a lesser house that you can truly afford. You will save yourself a lot of stress and worry by calculating what you can reasonably afford for a house payment and sticking to it when you look at houses. Don't be sucked in by seemingly attractive terms that sound too good to be true. |

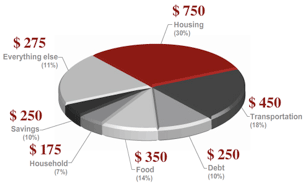

Image of monthly debt calculator

monthly debt calculator Image 1

monthly debt calculator Image 2

monthly debt calculator Image 3

monthly debt calculator Image 4

monthly debt calculator Image 5

Related blog with monthly debt calculator

- bobbisbargains.blogspot.com/...each debt amount, the interest percentage and monthly minimum payment. You then input the amount you can spend toward paying off the debt. The calculator then lists out exactly how much...

- snickerplum.wordpress.com/...you can try using to customize your debt calculator. There are also things...that you make above and beyond the normal monthly payments that you are...

- financemanage.wordpress.com/...it in some time. Besides, debt calculator can be very helpful for you to...off the whole amount of your debt. It’s really very important to...will help you to manage your monthly payments and your budget...

- freedebtsolutions.blogspot.com/...there some debt consolidation calculators that were made specially for credit card debt . There you will have to...and pay only the minimum monthly bill, how much if you...

- hottipsblog33.blogspot.com/...consolidation options. With the debt elimination calculator, you and your advisor are able to find out the most reachable monthly savings that you can incur...

- debtconsolidation-calculator.blogspot.com/...plan that you can do. Using a debt consolidation calculator will give you a good idea on how much money you can actually save on the monthly payment that you make from the usual amount...

- phandroid.com/... within a specific price range, based on income, down payment and monthly debt information. A refinance calculator that allows consumers to compare their current loan and new...

- frugalmakescents.blogspot.com/...if she switches to water. Then that extra money could be added to her monthly debt pay off and then to her savings. Until tomorrow........... Please feel free to share...

- pribsmusings.blogspot.com/...I've been thinking about the debt that I have. I have an American Express...I get paid every Thursday and budget monthly so every 3 months there is a...

- wonkydonkey.wordpress.com/...commitment to make a big dent in my debt by the end of 2011 (can you say... across a great, FREE, online calculator that helps to prioritize your monthly payments. It ...

Related Video with monthly debt calculator

monthly debt calculator Video 1

monthly debt calculator Video 2

monthly debt calculator Video 3

0 개의 댓글:

댓글 쓰기