About 'debt to net worth ratio formula'|How to Reach $1 Million

The internet is filled with desperate homeowners, who are hearing, that even after the golden ticket of a "trial modification" they are being denied due to the NPV formula. Banks like Chase and OneWest, formerly IndyMac Bank, are using this formula to deliver devastating news to those holding on to hope. Since many of those borrowers going for a modification do not know what that means, here is an explanation of the make it or break it formula. The guidelines for most looking at the qualifications for HAMP or Obama's Home Affordable Modification Program look simple. However, many homeowners are finding a twist that the US Treasury Department and the FDIC failed to make clear to borrowers who may be trying to obtain a loan modification. If you were fortunate enough to get a " trial modification," prepare yourself for a possibility of being denied due to the NPV. Participating lenders are supposedly required to use the NPV test on each loan that is at risk of default or at least 60 days delinquent. This test decides if the lender, when making the consideration of the DTI(debt to income ratio of 31%, ) will make more money by foreclosing and selling the home or by modifying it. If the NPV shows a positive return, regardless of the amount for the investor, they must modify((meaning they will make more over the length of the loan in interest). If it shows that the lender, after taking into consideration the NPV will come out making more profit foreclosing, then they will. The problem with the formula is that if a borrower has significant equity, they are pretty much doomed in receiving a modification. For example if the borrower who is going for modification has a home with a mortgage of $200,000, but the NPV says the home is worth $400,000. Then, when considering modifying, the lender computes they will make less money than the $200,000 profit based on the change of interest rate and extension of length of the loan, the lender will choose to foreclose and sell the home. The NPV guidelines, include property values, home price appreciation assumptions,(funny...I remember a comment about assuming anything!), foreclosure costs and borrower possible redefault. The other issue with NPV is that with lenders, such as OneWest Bank, formerly IndyMac Bank, who have a special deal with the FDIC(which covers 80% full face value loss on homeowners loans), is lack of full disclosure to the borrower. There is no way for the borrower to know if the NPV in these circumstances are being tested against the deal that is in place with our government. There is a possibility of deceit and error against the borrower. According to a loan modification specialist, working in the escalation department of one of the large lenders participating in HAMP. the borrowers who are denied to the NPV are not given the specifics of how it worked against them. Although, borrowers are to receive modifications based on the formula of the US Treasury Department HAMP's program, there are cases, such as with Bank of America, who purchased Countrywide, who is giving out automatic modifications to borrowers who are behind, without even a modification package submitted. Some of these borrowers are more than 2 years behind in their mortgage payments! The problem with using the NPV formula against homeowners in distress, is that it can reward those that financially extended themselves the most during the housing boom, than those that are going through difficult times due to job loss, illness, etc and were more conservative. If you have equity in your home, and cannot refi, you may be in more danger of losing it with a modification according to HAMP or the home affordable modification program based on your NPV. Especially if your lender chooses to use it or if your lender has a special deal set up with the Treasury Department. If you have received a trial modification, be proactive and request information on your loan regarding if your lender is using the NPV. Also question if your permanent loan modification is being denied due to the lender being in a better financial position by foreclosing and selling your home. Its all about profits and little about humanity. |

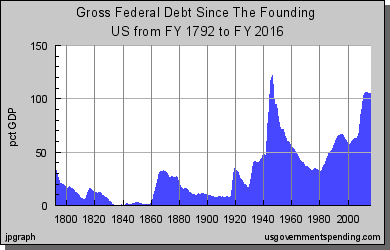

Image of debt to net worth ratio formula

Related blog with debt to net worth ratio formula

- www.freemoneyfinance.com/...visit our website to receive a free...Ha! Compute net worth once a year? I...in my estimation.) Debt Load ratio (Total ... in his formulas, and for people...

- matthewandrews.typepad.com/mattandrews/... debt/gdp ratios than developing... ago high debt burdens ... up beholden to multilateral and bilateral...Philipp's post is worth a read (as is...

- theautomaticearth.blogspot.com/... by the SEC itself, as the agency did not do enough to force Wall Street firms who shoved debt into off-balance sheet vehicles that many thought...

- www.freemoneyfinance.com/...In essence, the formula for it is: Net worth (not ...And here's how to tell where you should...Capital to Income Ratio (the multiple of...value of my (totally debt-free) home in the...

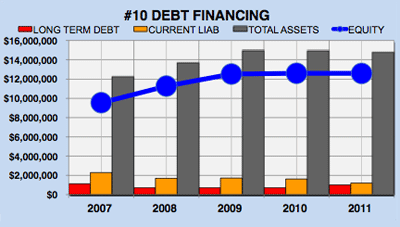

- helpwithassignment.blogspot.com/...’ equity and notes to the financial statement. This article...on Finance which include: Financial Ratio Formulae , Present Value , Net Present Value , Internal Rate of Return...

- theautomaticearth.blogspot.com/... because the country’s social safety net is in tatters, with ... are allowed to import equipment while paying little or no...

- www.freemoneyfinance.com/...legal tender for all debts public and private”, yet... a unit of our net worth, those ...really only be used to buy resources...

- vincentchan.wordpress.com/.... Its formula is ...EV = Market Cap + Net Debt Market Cap = Read...EBITDA tries to measure the intrinsic...debtor. (The other two ratios only look at it...

- geeman655.wordpress.com/...they are trying to do now. It is as if...like DO NOT DO RESEARCH ON THE NET. They couldn’t write the stuff... the pay that good, worth telling lies...

- theautomaticearth.blogspot.com/...difficult economic situation, it is right to stop it." The FSA said the ban would... on shorting would be formulated. Mr Brown said: "I think you'll find...

Related Video with debt to net worth ratio formula

debt to net worth ratio formula Video 1

debt to net worth ratio formula Video 2

debt to net worth ratio formula Video 3