About 'financed by debt'|Debt Proof Your Christmas by Mary Hunt-Personal Finance Book Review-All-Cash Holidays

I casually dug a small trench some years back, dabbling with a shiny plastic card and my new found spending power. I paid that card down, and spent again, and paid it down and spent again. I was rewarded with an ever-increasing credit limit, and my credit score climbed little by little. I was on top of the world. I managed my payments wisely, made sure that I could afford them, and added another shiny card. I spent a little, paid a little, spent a little more, paid a little, spent a little more, paid a little. Soon, the balance had grown to a large amount. The combination of my two shiny plastic cards, a financed vehicle, and an auto repair place line of credit was becoming a monster. So I worked harder, and paid more. The first time I missed going somewhere because I couldn't buy tickets because my cards were maxed out and my bank account was empty due to making the payments, I felt a little deflated. All my spending power and suddenly, I was the only one of my friends who couldn't buy a hundred dollar ticket. Oh well, I made my payments just the same. In the middle of the growing debt problem (and addiction to credit), I had a couple kids. Kids are expensive. I found that we missed out on some fun things because of the increased living expenses and the unbeatable debt-monster. It just kept hanging around. At this point, I had never missed a payment, because my credit score was like a crucial key to my identity. Missing a payment and messing that up would be devastating to me. My credit score hit a plateau, I had too many high balances. So, the score was a high number, but it carried with it a lack of buying power because my balances were too high. This was infuriating, because I wanted my buying power back. I was stuck with this addiction to raising my credit score, feeling powerful because of my good credit, and a sudden inability to use that credit. Along the way I learned about debt free living, and thought it sounded "cool." I kept hearing about it, and even knew a few people who were trying to become debt free. They were following this zero budget and a debt snowball, and were raving mad about this guy named Dave. So I started checking out that guy named Dave's material. Now, I have a debt snowball. I'm only on baby step #1, but instead of worshipping a credit score, I want to worship God. He's pretty clear in that good ol' book, ya know, the Bible, about not being slave to the lender. If you're interested in living debt free, but don't know how to get started on the right path, then check out Dave Ramsey. I haven't taken the course, but I've heard lots of recommendations for his Financial Peace University. If you have a lurking debt-monster, and would like to kick it to the curb, Dave has tools, tricks, and advice that will help you do just that! |

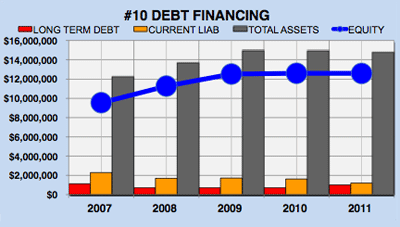

Image of financed by debt

financed by debt Image 1

financed by debt Image 2

financed by debt Image 3

financed by debt Image 4

financed by debt Image 5

Related blog with financed by debt

- californiarevolution.blogspot.com/.... It is also worthwhile to mention that our government is financed by debt. Granted, he is a very stupid man, but his religious beliefs...

- globaleconomicanalysis.blogspot.com/...the budgeted amount by $601 million are ...keep servicing its debt, said Richard Francis... substantial financing that’s letting the...

- coralvillecourier.typepad.com/community/... average of $27,000 worth of debt today. Two years after... to a recent report by the New York Federal Reserve...4% at the three-year mark. via finance.yahoo.com

- don-thelibertariandemocrat.blogspot.com/...straightforward; just read the FT’s Alphaville . The US has long financed its fiscal deficit by selling debt to China." So here's why it still might: "Looking forward...

- sriramkhe.blogspot.com/...institution in 2003-04 but did not complete their bachelor’s degree by 2009 have more than $28,000 in student loan debt. For some, the debt burden can be far worse. Jim VanNest, 30, ...

- financeprofessorblog.blogspot.com/Firm Size, Debt Capacity, and Corporate Financing Choices by Senay Agca, Abon Mozumdar...Mozumdar, Abon, "Firm Size, Debt Capacity, and Corporate Financing Choices" (December...

- articlesofinterest-kelley.blogspot.com/...government and the foreign and finance ministries ...and the UAE to drop on debt owed by Iraq. He said government... set by the Commission in the Ministry...

- barcepundit.blogspot.com/...York Times a Zapatero es esto: Mr. Zapatero said that the government could finance its initiatives by taking on more debt. “I support balanced accounts, I support fiscal balance, but I also think...

- prudentinvestornewsletters.blogspot.com/... will come from government bond issuance (red ellipse). So previous debts will be financed by issuance of new debt...thus today's accrued quadrillion yen milestone...

- timzaun.typepad.com/timzauncomtims_business_e/...holiday season this year? Personal Finance author, Mary Hunt, guides you towards a debt-free Christmas, (or..., please read my Debt-Proof Your Christmas...

Financed By Debt - Blog Homepage Results

Derek at Life and My Finances wrote an awesome post called “How to Get Out of Debt Fast” 5 amazing ideas for concurring your debt.

Managing Your Finance,Debt, Mortgages And Insurance Information Everyone Should Know. Information all about Car and...

...fascism with comments on finance, economics, politics, music, art... bartered away by the elites who have...ll be paying off their debts.

Related Video with financed by debt

financed by debt Video 1

financed by debt Video 2

financed by debt Video 3