About 'asset to liabilities ratio'|Global Pension Assets Hit Record High in 2010

Each of us may not have the ability to become President of the United States but we each have the ability to invest as he does! The question though is should we? The answer is apolitical; your political beliefs should not affect your investment choices, especially when we are looking only at the broadest of assets classes. President and Mrs. Obama are required to file annually a disclosure of their assets, liabilities and income. This requirement applies to most public officials and is supposed to reveal the potential for any conflicts of interest. It is obvious that if an official owns shares, substantial or not, in any public company that their actions could influence the price of the stock. The format that the public officials are required to use, allows the results to be reported in what some may consider to be unusually broad brackets. The Obama's report indicates that they have assets between $2.8 million and $11.8 million. They have a very simple portfolio keeping $1.1 and $5.25 million in Treasury Bills, $1-$5 million in Treasury Notes and between $350,000 and $700,000 in the Vanguard 500 Index Fund. In addition, they report having between $250,000 and $500,000 in a checking account at JP Morgan Chase. The portfolio doe not contain any specified exposure to foreign securities, gold or even municipal bonds. As appropriate there were no holdings of individual companies We will assume that the holdings are at the lower range of each category, just for fund and analysis. This being the case then definitely the Obama portfolio is geared toward safety of principal with 75% of the portfolio being in U.S. Treasury debt. Income is not a consideration because the money at JP Morgan Chase yielded less than $1,000 in interest, The choice of the Vanguard fund, is an excellent one. The expense ratio is only 6/100 of a percent which makes it an extremely efficient way to gain exposure to the broad market at a reasonable cost. Of course, the Obama's are not invested for growth and I dare say that a return is not high on their list. Their greatest asset is their intellectual capital and the earnings potential of President Obama, once he leaves office is boundless. As it stands now, his income from book royalties dwarfs his salary as President. However, there are lessons that we can glean from the President's portfolio. The first might be to make sure that the portfolio suits your needs and objectives. In this case, I would argue that it does. It is comprised of two basic investments, a debt instrument that many consider to be among the safest in the world and a low cost mutual fund which replicates a widely followed index, somewhat immune from Presidential influence. It would be hard to find controversy with these choices. If in October 1991, you had invested 25% in the Vanguard 500 Index Fund and 75% in the Vanguard Short Term Treasury Fund you would have enjoyed a return of 6.27% annually. Over the last ten years the return would have been only 3.87%. You would have captured nearly 80% of the return of all the S&P 500 with about 35% of the volatility. That may cause us to wonder if we are not placing too much emphasis on pure growth. If we think that we will have extraordinary earning potential through our career then perhaps there is less need to take on more volatile investments. However, we may also want to make sure that we keep an eye on the expenses that we pay to the fund family, More from this contributor: Personal Strategic Defaults are a Character Weakness Financial Infidelity is On the Rise Divorce American Style |

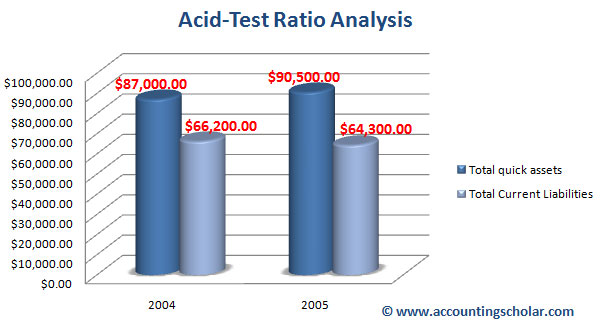

Image of asset to liabilities ratio

asset to liabilities ratio Image 1

asset to liabilities ratio Image 2

asset to liabilities ratio Image 3

asset to liabilities ratio Image 4

asset to liabilities ratio Image 5

Related blog with asset to liabilities ratio

- fredmba.blogspot.com/...to understand if a company can reimburse its debts with its assets. Debt-to-Assets = Total Liabilities /Total Assets The lower ratio the better as it means that the company can reimburse its debts...

- stocknewsportal.blogspot.com/...measure the health of working capital, divide current assets by current liabilities to get the �current ratio.� A current ratio of two to one or better usually...

- harbinus.blogspot.com/... to being ... a LTM P/E ratio of 8.06. The balance...of 5:1 (short-term assets:short-term liabilities). CESV has...

- cuesskybox.squarespace.com/..., consider the ratio of assets/liabilities. This ratio helps credit unions...a handle on a business’ ability to pay its bills. If a...

- basunivesh.wordpress.com/... Coverage Ratio is (102000/1575000...Net Worth :-In simple term to explain this is, your total Assets-Liabilities.High Net worth means...

- pensionpulse.blogspot.com/...during 2011, with the ratio of global assets to liabilities well down from its...about matching assets to liabilities. And with the growth...

- tipggita32.wordpress.com/.... Just what any country’s real debt to GDP ratio might be if these assets/liabilities were included in the equation is...

- pensionpulse.blogspot.com/...pension fund balance sheets 1 globally continued to strengthen during 2010, although the global asset/liability ratio is still well down from its 1998 level. According...

- harbinus.blogspot.com/... a price to book ratio of 1, or a trailing...target price attempts to be conservative in estimating...publication accepts any liability whatsoever for any loss or damage...

- timothymccandless.wordpress.com/...the corporation was in technical default because the corporation’s liability to asset ratios no longer met the bank’s requirements. ( Ibid. ) The bank...

Asset To Liabilities Ratio - Blog Homepage Results

optimalby

...Cross Purchase Crummey Power Cummulative Tax Current Assets Custodianship Deferred Compensation Arrangement...Insurance Kiddie Tax Life Estate Limited Liability Company Living Will Long-Term Capital...

Related Video with asset to liabilities ratio

asset to liabilities ratio Video 1

asset to liabilities ratio Video 2

asset to liabilities ratio Video 3