About 'industry comparison financial ratios'|...Similarly, the cover price of the Financial Times is $2...collective consciousness of the retail industry. Two, buisinesses...never had a 1:1 time ratio, historically. It's a bit like...

A big difference between bonds and stocks as investments are that bonds are considered 'bear' investments and stocks are considered 'bullish'. In other words, when the stock market is being flailed and vulnerable to 10-20% swings, more cautious investors may head for the bond market in which returns may be more stable and/or fluctuate less. Some investment advisers believe it is sensible to diversify investments between the two markets via portfolio ratios such as 30:70, or 40:60. In turn, this can be an indicator of a particular firms stance on the market. Bonds and Stocks really are two different breeds of investment. Bonds, especially the Government kind, are less vulnerable to recessions and weak market conditions because their value is tied to their interest rates. The value of stocks however, is generally not coupled to interest rates per se, but rather share price via economic and market conditions. While a change in the Federal reserve funds rate may influence stock prices, these changes in valuation are correlation only and not an absolute relationship as with bonds. Risks and Rewards: There are risks and rewards associated with both bonds and stocks because of principles such as opportunity cost and market timing. Time value of money is also a factor in the pricing of investments because present values of an investment are determined in part by the future flow of income and/or capital gains via stock dividends, bond interest payments, as well as changing industry and/or market conditions. As these things change, the foreseeable value of investments can rise or decline because of better investments such as higher yielding bonds, a giant new contract for a newly financially streamlined company, or an IPO in a high demand industry. Risks and rewards associated with stocks and bonds are listed below: *Financial Stability: In the case of bonds, an investor can generally have more peace of mind because even if interest rates do rise causing the price of bonds to lower, the percentage fluctuation in price is likely to not be as great as can occur in the valuation of stocks. *Earnings Potential: The earnings potential is most often higher in the stock market because stock prices are essentially unlimited in how much they can rise. For example, a stock price can rise as much as 50% over the course of a few months under certain circumstances whereas the chances of this type of percentage rise affecting a bond is significantly lower. *Opportunity Cost: If one has bought a substantial position in Bonds, such as 80% of one's investment portfolio and a dramatic improvement in economic conditions emerge, the return on stocks could prove fantastic in comparison to bonds making the opportunity cost higher of holding the bonds higher. *Leveraging: When one has investments in Bonds one may be able to take out loans against those Bonds and in effect leverage a new position into another financial instrument. In other words, a financial institution or private lender may view paper or Government bonds held outside of an exchange as good collateral for a loan which can be used to make further investments. With stocks, such leveraging may not be as likely due to their potential volatility and nature of exchange. *Timing: Since the primary risks involving bonds is that interest rates on bonds may rise after bonds have been purchased and vice versa, how an investor uses time in each market becomes a potential risk or reward. That is to say, if an investor does not time investments well by entering too early, or exiting too late, that investor faces timing related risks and rewards. In the former case, if one buys bonds with an interest rate of 3.5% fixed returns and the rate changes to 4% the value of the 3.5% bond becomes lower, the investor has in essence been affected by timing risk. The same holds true for stocks. For example, if an investor takes a position in a company that is very financially strong, if the timing is wrong, the investor may still lose. This is especially true in companies that benefit from seasonal and cyclical trends. Deciding What to Invest In: Making the decision to invest in stocks and bonds does not have to be daunting. It is for all intents and purposes impossible to predict all financial conditions, price movements and economic conditions. While forecasting, technical analysis and fundamental analysis of financial information can assist with predicting investment outcomes, eventually an investor either decides to invest, not invest or think some more. When choosing stocks and/or bonds one may consider the above information in determining how much of each investment would be prudent given current financial trends and data. Conditions in the stock market can affect conditions in the bond market and vice versa. Bonds often serve as a hedge against stocks, and stocks assist in capitalizing on market conditions. By investing in both, one can potentially benefit from the best of both financial markets. |

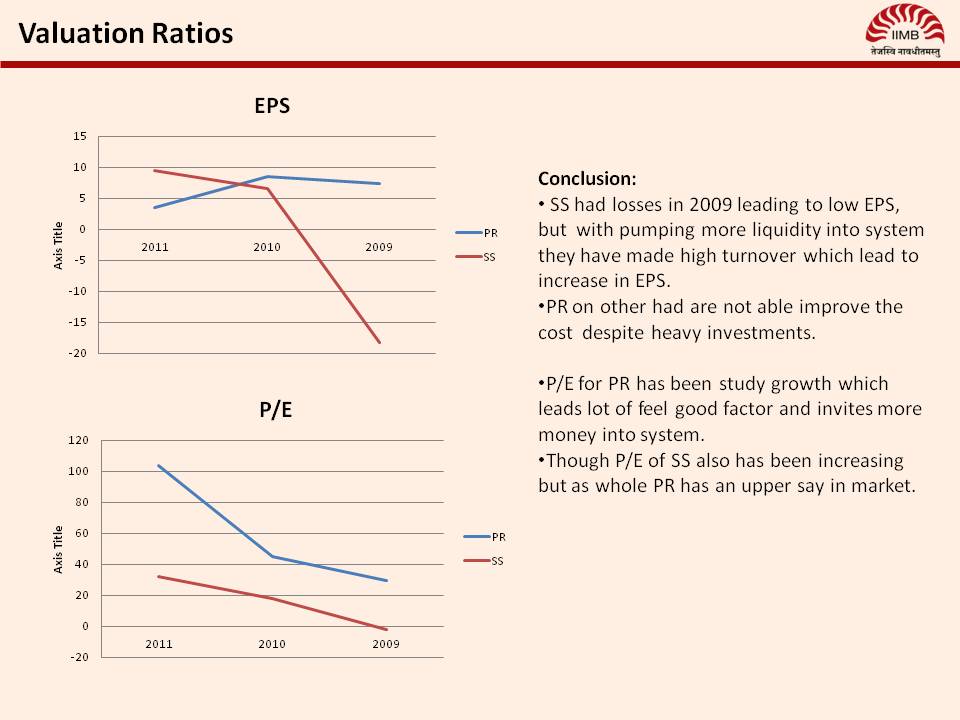

Image of industry comparison financial ratios

industry comparison financial ratios Image 1

industry comparison financial ratios Image 2

industry comparison financial ratios Image 3

industry comparison financial ratios Image 4

industry comparison financial ratios Image 5

Related blog with industry comparison financial ratios

- anandvijayakumar.blogspot.com/...Financial Ratios: Financial ratios can be used for comparison • between two or more...between two or more industries (ex: comparison between the...

- gaultslue.blogspot.com/...Similarly, the cover price of the Financial Times is $2...collective consciousness of the retail industry. Two, buisinesses...never had a 1:1 time ratio, historically. It's a bit like...

- ivythesis.typepad.com/.... Aside from eternal comparison, companies applying financial ratio analysis also have to compare the...position in the market. (b). Key Industry Success Factor Analysis Key industry...

- jeremyowinvestingexperience.blogspot.com/... a comparison between the .... This ratio seeks to... at a financially healthy level. Almost... in different industries may also carry very...

- myinvestingnotes.blogspot.com/...really there unless you make a comparison across the industry. Other liquidity ratios include working capital...can deal with its long-term financial obligations and...

- cbpowerandindustrial.wordpress.com/...fantastic resource for both company and industry information. It has company news, financials, SWOT analyses, ratio comparisons, peer analysis, and more. It ...

- customerexperiencematrix.blogspot.com/... put the client-per-employee ratios in deeper perspective. They confirm that...the highest revenue per employee in the industry. The figures may be be ...

- wyomingentrepreneur.typepad.com/blog/... are often monitored using various financial ratios. Industry comparisons can be found in trade associations or other...

- wyomingentrepreneur.typepad.com/blog/... are often monitored using various financial ratios. Industry comparisons can be found in trade associations or other...

- strange-japan.blogspot.com/... to non-profits by a ratio of $2 corporate to every $1 employee, he ...relief efforts in Japan. MFS/Sun Life Financial 27 Sun Life employees in Tokyo, through...

Related Video with industry comparison financial ratios

industry comparison financial ratios Video 1

industry comparison financial ratios Video 2

industry comparison financial ratios Video 3