About 'calculate debt to total assets ratio'|Replies from AK71: Calculating gearing for companies and REITs.

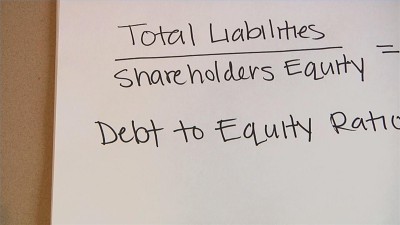

Different parties conducting financial analysis have different concerns and use different methods for determining the health and current position of a company. Short-term creditors are concerned with the company's ability to repay its short-term obligation and its ability to quickly turn its inventories into liquid cash. One method for determining a company's ability to pay its short-term debt, are liquidity ratios. Liquidity ratios are designed to measure whether or not a company has the ability to meet its short-term liabilities. There are two main types of ratios used; these include the current ratio and the quick ratio. The current ratio is calculated by dividing current assets by current liabilities. In calculating the quick ratio, inventory is excluded from current assets and the remainder is divided by current liabilities (Logue, Modern Finance). The inventory is excluded because many analysts feel that inventories are generally less liquid than other items in current assets. Therefore, the quick ratio is more likely to present a better snap shot of the company's ability to pay its short-term obligations. Measures of long-term solvency are used in assessing the firm's ability to meet interest and principal payments on long-term debt and similar obligations as they become due. If the payments cannot be made on time, the firm becomes insolvent and may have to be reorganized or liquidated. Perhaps the best indicator of long-term solvency of a firm's ability to generate profits over a period of years. If a firm is profitable, it will either generate sufficient funds from operations or be able to obtain needed funds from creditors and owners. The measures of profitability are debt ratios and the numbers of times that interest charges are earned. There are several variations of the debt ratio, but one most commonly used form is the long-term debt ratio. It reports the portion of a firm's long-term capital that is furnished by debt holders. To calculate this ratio, total noncurrent liabilities are divided by the sum of total noncurrent liabilities, minority interest in consolidated subsidiaries and total shareholders' equity. Another common form of the debt ratio is the debt-equity ratio. To calculate the debt-equity ratio, total liabilities (current and noncurrent) are divided by total equities (liabilities + shareholders' equity=total assets). (Logue, Modern Finance) Operating efficiency analysis is used to determine what factors give one company a marketplace advantage or disadvantage in terms of sustaining profitability through periods of economic stress or serious competitive pressures. Statically, a company's relative efficiency can be measured in many ways: gross margins; operating margins; return on capital; labor costs in relation to sales; finished goods/sales; and ratio tools. Cost advantage can be traced to the relative degree of integration of manufacturing operations. Companies that meet Occupational Safety and Health Administration (OSHA) Standards should have good capacity to expand or modernize facilities to improve operating or production abilities. Price leadership is also taken into account, while price leadership is generally a function of market share, price policy in itself is far more important to operating margins than it s to the total dollar sales position. (Amlings, Investment) Overall, before investing into a firm; investors, creditors and all key stakeholders should examine the financial and operating performance of the firm. There are many different ways for examining the firm's activities and measuring its financial and operational performance. A variety of techniques are used to forecast the cyclical short and long-term trends of business conditions, but overall none are perfect. Methods for measuring alone are not reliable; they should be used in conjunction with a review of the firms financial statements to present a better picture of the overall health and condition of the company. References Logue, D.E Handbook of Modern Finance Financial Statements retrieved May 19, 2009 2009 Amling, F. Investments: An Introduction to Analysis and Management, Englewood Cliffs, N.J Prentice Hall Retrieved May 19, 2009 |

Image of calculate debt to total assets ratio

calculate debt to total assets ratio Image 1

calculate debt to total assets ratio Image 2

calculate debt to total assets ratio Image 3

calculate debt to total assets ratio Image 4

calculate debt to total assets ratio Image 5

Related blog with calculate debt to total assets ratio

- datacenterlinks.blogspot.com/...debt to asset ratio ...fair thing to complain about... Total Debt to Total Assets as: "A metric...by debt. Calculated by ...

- eboatloans.wordpress.com/...and below, your total debt including...payment needs to be below $650. That...your debt to income ratio. If you own property...and most of your assets are held...

- basunivesh.wordpress.com/...Coverage Ratio :-This ratio will gauge how...liquid cash available to pay your debt. It may help you...burden. This can be calculated as Liquid Assets/Total Debt. I will consider...

- ulvog.wordpress.com/...concept of this ratio is to look at how...change in net assets (okay, okay, you... by the total P&I ... I would calculate the debt coverage ratio...

- myinvestingnotes.blogspot.com/... for with debt. Total debt to total assets is calculated as follows: When using this ratio to make an analysis of...

- financecosmos.wordpress.com/...the Fixed Asset Turnover ratio, the more effective...RATIOS 1. Debt to equity ratio Debt...financial leverage calculated by dividing its total liabilities...

- waelsasso.wordpress.com/...Long Term Debt). Note...formula Assets = ...should add to Equity while calculating the Balance...the ratios in the...every total ...

- beginnersstockinvesting.blogspot.com/...and the ability to service debt, return on equity, return on assets and so on. But as a beginner... game, the price to earnings ratio is a good why to...

- singaporeanstocksinvestor.blogspot.com/... calculated as Long Term Debt/Shareholder...while its total equity... to $95.159...as debt ratio.. but y...at Debt/Assets. Therein...

- coobulldog.wordpress.com/... to calculate ratios, often ... refer to non-monetary assets, such as equipment...denote credit and debt, which we will... total asset turnover...

Related Video with calculate debt to total assets ratio

calculate debt to total assets ratio Video 1

calculate debt to total assets ratio Video 2

calculate debt to total assets ratio Video 3